A healthy financial life is built on a budget.

You can create a budget to make sure you have the money you need for what is important. These 20 budgeting ideas are not restrictive but rather help you to get a better understanding of what you spend your money on. They can also help you find extra money that you could use.

Budgeting successfully allows people to achieve debt relief faster, save more money over time, and spend wisely. Budgeting is easy to do and only requires a few small changes to your daily money routine.

There are certain things worth doing each day. Staying active and maintaining good hygiene are important for our physical health. Why is it that we find it difficult to maintain the same level of care in our daily lives to improve our financial standing? Learn about simple and quick things that you can do each day to stay on budget.

-

Create your monthly budget in advance

-

Use the budgeting tool HTML0 to practice your budgeting.

-

Choose the Right Tools

-

Identify needs and wants

-

Keep receipts and bills organized

-

Prioritize debt repayment

-

Fun is important

-

First, save and then spend

-

Contribute to your retirement today

-

Split your direct deposit

-

Be prepared for the unexpected

-

Plan large purchases

-

Add a category for contingencies

-

Monthly Budget

-

Describe specific and realistic goals

-

No-spend days

-

Do not be hard on yourself

-

Using only cash as a budget

-

Your financial budget

-

Be Flexible

1. Budget your monthly expenses before they begin

Plan ahead to stay in control of your budget. Plan your expenses and activities for the next month a week in advance.

You may be able to plan a trip, or veterinary appointment for one month and not another. After you plan your monthly schedule, create a budget that is realistic.

2. Budgeting at zero

To budget to zero, you must track every dollar that you make and allocate it to your budget.

Say, for instance, that you make $4,000 per month. You should not have any money leftover after budgeting for your investments, savings, fixed costs, and additional expenses.

You can see where you are spending your money and what you’re doing with it by budgeting down to zero.

Prepare yourself with the tools you need to succeed right from the start. Use an app to track your spending or keep tabs on healthcare or shopping costs. Budgeting apps can be powerful tools that help track your spending, encourage you to set priorities and pay your bills first and warn you when you spend too much in one area.

4. Needs versus Wants

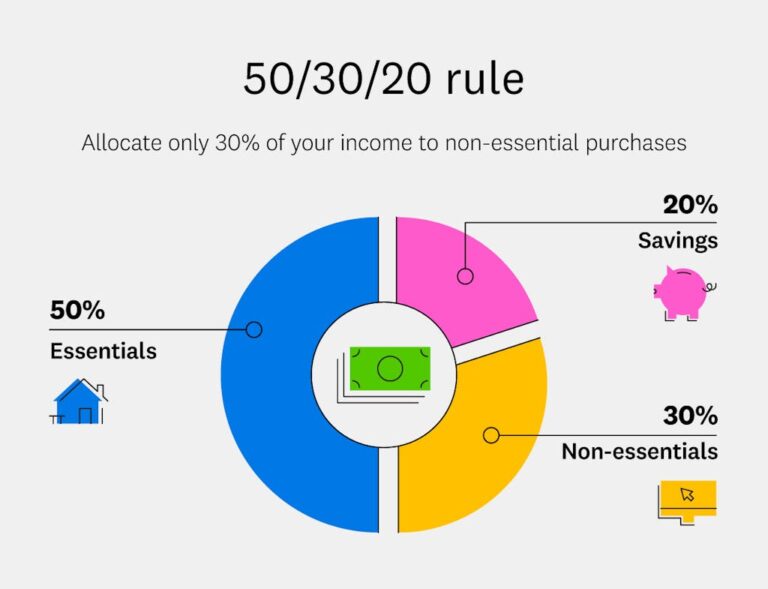

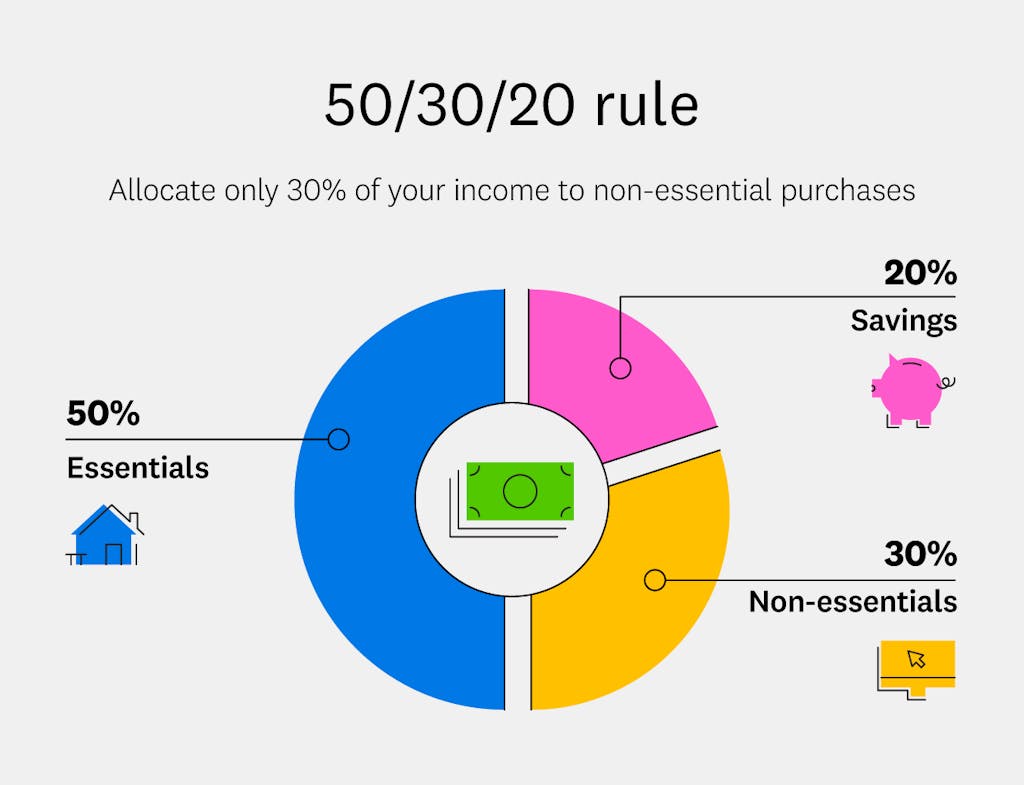

Image: 50-30-20-rule

Needs are things that you need to survive, such as food, rent, and repayment of debt. Credit Karma has a budget calculator that can help you determine these costs.

Use the 50/20/30 Rule. This rule states that you should allocate approximately 50% of your earnings to necessities, 20% for savings or debt, and 30% for non-essentials.

5. Bills and receipts should be organized

If you ever need to go back and dispute a bill, keep your receipts and bills organized. It may be useful for tax purposes.

If you choose physical filing, then use expandable or hanging folders. Sort your documents, if you choose to do so, by account, month or whatever works best for you. You may prefer to store all your documents electronically if you get most of your receipts and bills via email.

6. Prioritize debt repayment

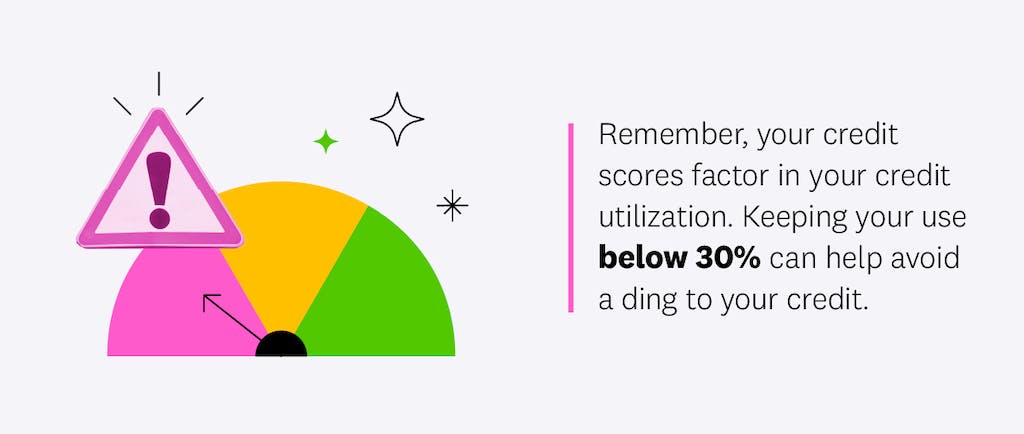

Image: credit-score

Prioritizing your debt repayments can save you money and relieve financial pressure. Keep your debt low because this will affect credit usage. It’s generally best to limit your credit usage to less than 30%.

7. Fun is important.

A budget that is both realistic and fun should be part of your overall plan. You can enjoy yourself without worrying about overspending if you set aside money for non-essential activities.

Set aside some money every month for a fun weekend, night out with your friends, or special treat. This will help you stay in control of your finances.

8. Spend first and then save

Consider saving as an expense that you must budget for. Warren Buffett says that it is important to prioritise your savings and recommends automating the contributions in order to avoid temptation.

9. Now is the time to start saving for retirement.

We’ve probably said it before but it’s worth repeating: it’s never too soon to begin saving for your retirement. Consider maxing out the retirement match program offered by your employer. Early planning can help you avoid putting extra pressure on your finances later as you try to catch up.

10. Split your direct deposit

Consider setting up your direct deposit with your employer so that you receive a percentage of your salary directly into your account. Automating the process will do all of your work.

11. Expect the unexpected

Image: plan-your-budget-in-advance

Even the best-laid plans can’t always prepare you for unexpected costs. Unexpected expenses can include car repairs and trips to an emergency room.

It’s important to include an emergency fund in your budget. Start by saving the minimum amount you need to feel secure in case of an emergency. Experts recommend saving three to six month’s worth of expenses in order to be prepared for an emergency.

12. Prepare for big purchases

Plan ahead if you are considering buying an expensive item such as a laptop or television. Divide the cost by the days remaining until the date you choose to purchase the item.

If you wish to buy a $1500 computer within 300 days you only need to put aside $5 per day. You can avoid putting the purchase on a credit card and getting into serious debt.

13. Add a category for contingencies

Occasionally, an expense will not fit into the categories of your budget. A contingency plan can be very useful. The catch is that you can’t use it to justify overspending in other areas. Consider modifying your budget if you are consistently overspending in any area such as food or shopping.

14. Budget monthly

Budgets should not be fixed in stone. Your needs may change. You can reassess your budget every month to see how you are doing. Even out your budget if you find that you are consistently spending more in some categories and less in others.

15. Outline realistic and specific goals

Keep in mind that the easiest goals to achieve are those which are SMART – specific, measurable and attainable. They should also be relevant, timely, and obtainable. Try saying “This year I will save more” instead of “I’ll have $1000 saved by December 31 for an emergency fund.”

16. No-Spend Day

You can designate a day each week where you only spend money on what is absolutely essential. It’s easy to stay within budget by limiting your weekly expenditure.

Consider a month of no spending if you are having trouble saving money. Spending money on only the necessities for a month and saving the rest is the idea.

17. Do not be hard on yourself

It may take several months for you to get used to your new budgeting system. It’s possible that your budget will not be flawless the first time or even the second. As you adjust to your new budgeting routine, be kind to yourself. Make daily choices with budgeting in mind. This will help you establish new habits.

You will get more out of your money if you stick to your plan. It also gives you the peace of mind knowing that each dollar you put in your account goes to its intended purpose.

18. Budgeting with cash only

Budgeting with cash only involves using all payments in cash and keeping track of your spending regularly. It is easier to track your spending and stick to a budget when you use this budgeting technique.

Cash-only budgeting also allows you to be more conscious of your expenditures, as you are forced to track where you money goes.

19. Plan your budget for financial stability

You should consider your current financial status when creating a budget. Budgeting based on a possible income can lead to debt rather than savings. A budget which ignores a part of income can lead to you wasting money and ignoring wealth-building options like investing.

Set yourself realistic goals, such as saving, debt repayment and investment in the future. Be prepared to cover unexpected costs, such as car repairs and medical expenses.

20. Flexible

Our financial situations can sometimes change dramatically due to the unpredictable nature of life. Budgeting is all about having a plan, sticking to it and being prepared to change it when needed.

You can save money by cutting down on certain expenses, looking for ways to cut costs or exploring new opportunities.

Flexibility in your budget will help you build confidence and a strong financial foundation.