According to the 2020-2021 U.S Census estimates, Los Angeles is America’s 2nd-largest City, with more than 3.8 Million residents. Credit Karma data from August 17, 2022 shows that the average debt of 523,603 Credit Karma members living in Los Angeles is $62,323. The total amount of debt includes auto loans, auto leases and student loans. Credit card balances and medical debt are also included. (Click here to see the complete methodology.

Continue reading to see an overview of Los Angeles’ debt situation.

Snapshot of Credit Karma Stat

Total debt in Los Angeles

Los Angeles’ 523,603 Credit Karma members had a total debt of $52.5 billion. Average overall debt was $62,323. The median overall debt for individuals was $62,323. The average monthly payment for overall debt is $509.

Compared to this, Credit Karma members have an average national debt of $49,454 and a median of $11,223.

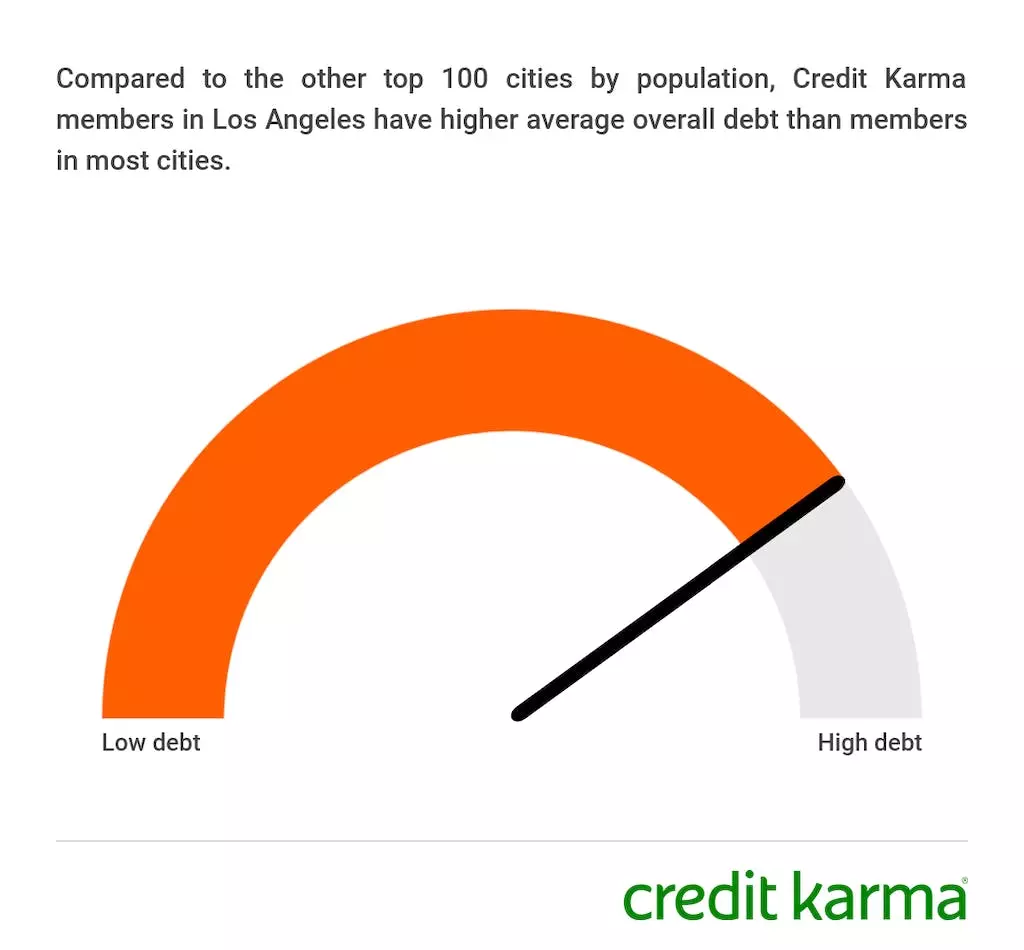

Los Angeles’ debt dial

Image: ladebtgauge-1

Student loans, auto loans, mortgages, and credit card debt in Los Angeles

Below is a table with averages and medians of different types debts among Credit Karma members Los Angeles.

|

Debt type |

Credit Karma members who have debt type |

Average debt |

Median debt |

Average next payment |

| Auto loan | 295,326 | $24,104 | $19,254 | $582 |

| Student loan | 170,318 | $35,038 | $14,747 | $50 |

| Hypothec Mortgage | 94,301 | $544,641 | $422,503 | $3,061 |

| Credit card | 508,540 | $6,837 | $3,230 | $186 |

How does Los Angeles’s population compare with the national average? Below is a table that compares the national average to the averages for Credit Karma members in Los Angeles.

|

Debt type |

Average national credit of Credit Karma members |

Los Angeles member average debt |

| Auto loan | $24,042 | $24,104 |

| Student loan | $32,004 | $35,038 |

| Hypothec Mortgage | $235,194 | $544,641 |

| Credit card | $6,469 | $6,837 |

Credit Karma members in Los Angeles had greater debt than the national average for all types of debt. Los Angeles is the most expensive U.S. city with the highest average mortgage debt.

Los Angeles ranks against other cities.

We compared the average Credit Karma member living in 100 top cities by population, according to U.S. Census 2021 population estimates.

Los Angeles was the 21st most expensive city among the 100. Credit Karma members in Los Angeles have the 21st highest overall average debt. This is compared to Glendale, California where members have $62,549 overall debt and Reno, Nevada where members have $61,223 overall debt.

Here are the top 100 American cities ranked by their population.

- Auto loan debt 41st

- Credit card debt: 24th highest

- Student loan debt: 25th highest

- Mortgage debt: 5th highest

Credit inquiries, past-due accounts and credit in Los Angeles

Credit Karma members in Los Angeles had an average VantageScore 3.0 credit score of 677, while the median score was 687. Both are good. Credit Karma members had a national average VantageScore 3.0 score of 673 and a median score of 682.

Los Angeles residents had an average of 3.0 inquiries on credit reports. The national average was 4.2.

Los Angeles residents have an average of 0.64 accounts that are 30 days late. Nationally, the average account is 0.74.

Methodology

We analyzed the accounts and transactions of approximately 523,000 Credit Karma members in Los Angeles, who were active within the past 36 months to determine the averages for each type of debt. The averages were calculated using information from TransUnion credit reports for members from the 90-day period prior to data pull on Aug. 17, 2022. This analysis includes auto lease, credit card, student loan, mortgage, credit card, and auto loan. Unpaid balances on open accounts at the time of data pull are all included. All numbers were round to the nearest whole in this report.

All data in this article were pulled Aug. 17, 2022.