What is a Financial Plan?

Financial plans are documents that help you measure the progress of your financial education by tracking your financial goals.

It can be hard to achieve your goals without a strong foundation and a plan for the future. A financial plan will help you to prioritize and track your progress on the path towards financial freedom.

It’s not difficult to plan your financial strategy. This is a guide that will show you how to create a financial strategy.

-

Assess where you are

-

Set SMART financial goals

-

Update your budget

-

Prepare for an Emergency

-

Repay your debt

-

Organise your investment

-

Retirement

-

Start your estate planning

-

Protect your assets

-

Tax planning

-

Review your plans regularly

A financial plan can help organize your finances and set goals, with an actionable path for you to achieve those goals. Consider what you have, your goals for the future, and how much you are willing to sacrifice to achieve them when deciding on where to begin.

How do you envision your future?

How to make a financial strategy in just 11 easy steps.

1. Assess where you are

Building a financial plan is similar to creating a fitness routine. You could waste time if you do not outline the steps you will take to achieve your goals. To create a successful financial plan, you must be honest with yourself about where your finances are weak and set goals for improvement.

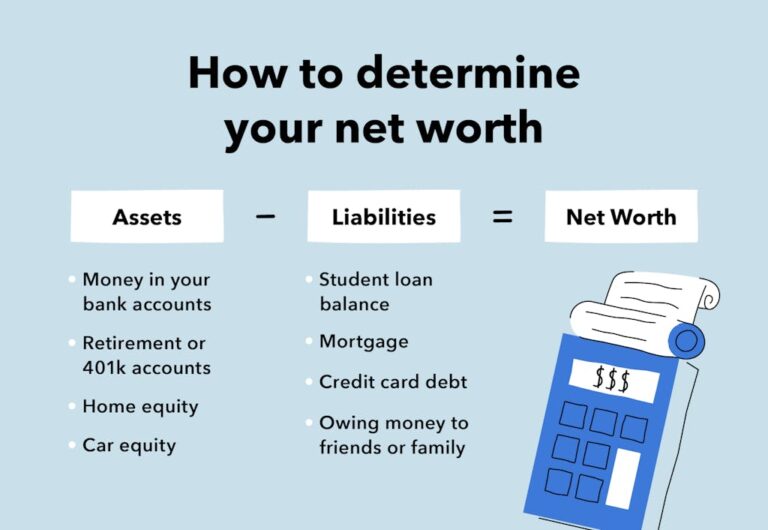

Calculate your Net Worth

Net worth is a way of determining your financial situation. Subtract your liabilities (whatever you owe), from your assets. Liabilities can be any loans, mortgages, or debts. Assets are things such as the equity in your car and home, and money you have saved up. How to determine your net worth by combining your assets and liabilities.

Image: Copy-of-net-worth-calculation

Over time, your ratio of assets and liabilities can change — particularly if you have paid off debts or put money in savings. A positive networth (assets greater than liabilities) generally indicates a healthy financial situation. Keep track of your current net worth in order to keep tabs on your progress with your financial goals.

Track Your Spending

Cash flow, or the difference between what you earn and how much money you spend is another way to assess your financial planning. Cash flow can be used to determine your financial standing.

A negative cash flow is when you spend more than you earn, which can lead to credit card debt or bankruptcy. Positive cash flow is when you earn more than you spend. This will help you reach your financial goals.

Set your financial goals now that you know your cash flow and net worth.

2. Set SMART financial goals

Set SMART goals for your finances (specific, measurable and achievable) to help you plan your financial future. Do you plan to use your money to repay debts? Consider buying rental properties. Are you planning to retire prior to 60 years of age?

Create a list with your dreams and goals, from owning a dog daycare to moving to Paris. Your financial plan should be able to help you achieve your goals in the long term, no matter how big or small they may seem.

You can break your financial plan down into smaller, more manageable chunks by using SMART Goals. Do you remember that dream of moving to Paris? You can make the dream of living along Seine River a reality by using SMART Goals. How to create SMART Goals.

Image: Copy-of-smart-goals

If you set concrete goals and keep yourself reminded of them, you will be more motivated to stick to your budget, and to make the best short-term choices to achieve your long-term goal.

It’s also important to realize that goals don’t remain static. Your financial plan should change as your goals in life do.

3. Update your budget

Budgeting can be a great way to understand how much you have available and what you need to save.

The 50/30/20 Rule is a great way to budget. This rule divides your income after tax into three different categories.

- Essentials (50%)

- Wants (30%)

- Save 20%

Image: Copy-of-50-30-20-budget

This rule can help you achieve your financial objectives.

It’s important to update your budget regularly and to plan how to reach it. If you are planning a wedding you may want to cook more at home each month in order to lower your monthly dining budget.

Budgeting for

You’ve probably already considered basic expenses like rent, credit card debt, and food when you put together your budget. What other costs should you be considering? Consider all the different expenses you may incur in a given month. Here are some items you should include in your monthly budget.

- Rent or mortgage

- Groceries

- Dine out

- Maintenance of household items

- Fund for Emergency Situation

- Memberships and subscriptions

- Travel

- Medical expenses

- Bank Fees

- Transportation or auto expenses

- Costs of pet care

- Enjoy the Entertainment

- Clothing

- Personal Care

- Charity

Start by reading our tips on budgeting. Try using a worksheet, paper, or an app for budgeting to start your financial plan.

4. Prepare for the unexpected

If you’re not prepared, unexpected costs could derail your plans. It’s a good idea to check your emergency funds, whether you are just getting started or have saved for many years.

You should have several emergency funds in order to cover you if an unplanned crisis occurs.

5. Reduce your debt

You may find it frustrating to spend your money on debt repayment and savings, but if you prioritize both in the end, this will set you up for long-term success. Understanding the differences between the two methods for paying down debt is essential so that you make smart decisions about your future financial situation.

Image: Copy-of-comparison-of-debt-repayment-options

Whatever the option that you select to repay your debt, it is important to stick to your budget as closely as possible. Even skipping one or two debt repayments could cause a financial crisis. It’s important to set up a budget you can adhere to.

Our budget calculator will help you to understand where your money goes.

6. Organise your investment

It may be difficult to understand the basics of investing, but once you do so, it will help to put your money at work to grow your wealth passively. You should decide how much you are comfortable investing before you begin.

Consider budgeting an amount from each of your monthly savings to be invested directly in your portfolio. This will serve as your contribution. These small amounts of money can grow over time into larger sums.

It is important to remember that investing takes time and patience. You’ll have to wait several years before you see any real results.

Are you ready to start your journey toward financial long-term success? Use our ROI investment calculator to set goals, predict earnings and estimate what you can earn in the future.

7. Plan for Retirement

It’s important to think about your long-term goals when creating a financial strategy. Planning for retirement early is important, even though it may seem like a distant goal.

It is better to start planning for your retirement as early as possible. You could save for retirement as early as your 20s and have over 30 years of contributions by the time your retire. In general, you should contribute more to your retirement account as you age. A good rule-of-thumb is to put away 10%-15% annually of your income after taxes in an account for retirement.

Retirement plan types

IRAs are the most popular retirement saving products.

- IRA –A traditional IRA, or individual retirement arrangement (IRA), is a “plan” for your own personal savings that you open and fund without any employer involvement. This type of retirement plan allows you to deduct the money that is put in. This is a tax-deferred account, which means you will be taxed when the money is withdrawn.

- Roth IRA – A Roth IRA, like an individual retirement plan that you have funded and opened yourself, is a Roth IRA. With a Roth IRA you are taxed up front rather than when the money is withdrawn.

- 401(k),A retirement account that a company offers to its employees. Contributions are usually pre-tax but your employer-sponsored program might allow post-tax payments.

8. Start your estate planning

Estate planning may not be fun, but it’s important. It’s important to begin estate planning when deciding how to make a financial strategy to determine what will happen to your assets after you die.

Think about how you’d like to divide your assets and whom you would want to know this information.

Estate planning with a lawyer

An estate lawyer can help solidify your financial plans even after your death. You can protect yourself from legal disputes or mistakes by clearly defining your estate plan. Here are a few things you should consider if you intend to hire a lawyer to help with estate planning.

- Hire an estate planning expert. Lawyers are specialists in their own fields, just like doctors. A financial plan can be built with the help of an estate planner.

- Be clear about legal fees. The cost of estate planning can vary greatly depending on your lawyer, and the services you require. Others charge an hourly or flat fee, while some lawyers base their fees on the complexity. You should discuss this with your attorney to find out which option is best.

- Choose a lawyer that you can trust. Planning your estate is an extremely personal issue, and you need to find someone with whom you are comfortable discussing personal details.

9. Protect your assets

You should begin to think about how you can protect your assets in the event of an unexpected emergency. Insurance may not seem as glamorous as investing but it is just as crucial to the development of a plan for your financial future.

Insurance Types

You can protect your assets with a variety of different types of insurance. When planning your financial future, you should consider the following insurance types.

- Life Insurance —Life coverage is a part of estate planning and will provide the funds needed to your beneficiaries.

- Protect your most important asset, which is likely to be your house, from disasters and crime. The insurance for homeowners can protect you from unexpected property damage or loss.

- Insurance — In order to receive coverage for all medical expenses, you must pay an insurance premium.

- Car insurance — Insurance for your vehicle can help you avoid costly repairs or thefts.

- Insurance against disability — In the event of an accident or illness, you will be reimbursed for any lost wages.

10. Tax planning is important

Knowing how taxes are calculated can be a game changer for your financial future. Taxes may seem inevitable, but you can reduce your debt by planning wisely. Take into consideration the following:

- Reduce your taxable income —To save money you can take advantage of investment opportunities that offer tax-savings, such as a 403(b), 401(k), or IRA.

- How do you itemize deductions ? Tax Deductions: A way to reduce your taxable income is to deduct eligible expenses and losses.

You may find that working with a professional tax advisor is helpful as your situation changes.

11. Review your plans regularly

Making a plan for your finances is not a once-off thing. You (and your finances) don’t stay the same, and neither should your plan. To continue to set yourself up for future success, it’s important to periodically reevaluate and modify your plan.

You may decide to be more aggressive with your insurance or retirement plan as you advance in your career. A young person who is in the first years of their career will likely have less money available to invest in retirement or savings than someone in their 30s with a more established career.

Reevaluating your financial plan is a great idea after major life events, such as marriage, children or losing your career. Take some time every few months to review your progress. Celebrate your achievements. It may motivate you to continue.

Ask trusted friends and family for their feedback on your financial plan. You might forget about something that your best friend would point out, such as the dream you had of living in an urban loft.

A financial advisor can help you review your plan and solidify it.