Having a little bit of optimism can be a great way to get through difficult times in the homebuying industry. If you feel too optimistic about your chances of purchasing this year, which is not justified in light of current economic conditions, you might be disappointed at best and overextended at worst. According to NerdWallet, […]

Having a little bit of optimism can be a great way to get through difficult times in the homebuying industry. If you feel too optimistic about your chances of purchasing this year, which is not justified in light of current economic conditions, you might be disappointed at best and overextended at worst.

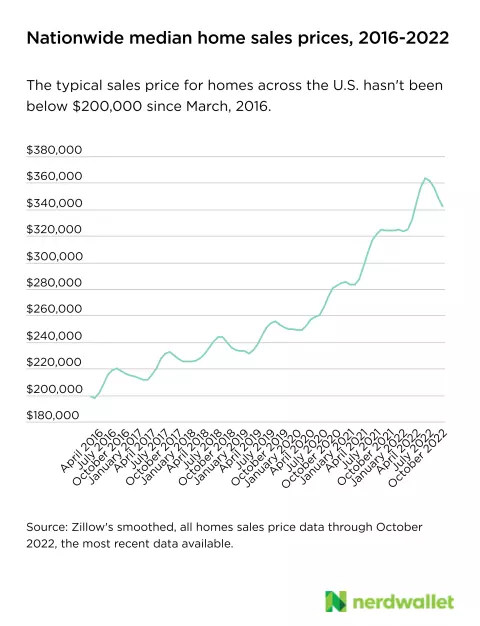

According to NerdWallet, 28 million Americans intend on purchasing a home within the next 12 months. They expect to spend $200,000. It will be difficult to spend $200,000. According to Zillow’s latest data, the median national sales price for all homes (including condos) is $342,000

Over the last two years, home prices have risen by over 50%. Due to too many buyers competing for homes, the housing market was saturated. Low mortgage rates fueled a boom in home prices. According to Zillow data, they have fallen slightly since June 2022’s peak of $363,000, but will likely fall in broad-based fashion in 2023.

Where will buyers find houses selling for $200,000 in their desired markets? It’s unlikely in the markets they want; high-demand areas command higher prices. This is always true. This analysis of sales prices and a forecast of where prices might fall over the next year shows that buyers won’t be able to find this kind of bargain in all areas of the country.

Current prices

A $200,000 budget will not go far in most markets, even if home prices slow down this year. Since early 2016, the median sales price hasn’t been this low. Only 204 of the 614 Zillow pricing data areas have median sales prices below $200,000 in October 2022. The majority of these smaller towns are located in areas that have a population below 10,000. Dayton, Ohio is the largest metro area with a sale price below $200,000, and has a population of 87,000.

According to Zillow data, the average price of a typical property in the 50 most populous metro areas was $419,000 for October 2018. These areas are more popular and buyers who want to buy should be prepared for higher sales prices than $200,000. These areas include not only the city center, but also surrounding neighborhoods and suburbs. So don’t expect to see six-figure sales prices.

Prices won’t fall far

For fun, how about if prices fall in a quantifiable way? Over the last few years, buyers have felt the pain of rapid and steeply rising sales prices. However, those high prices can’t be sustained in certain markets. In 2023, the most likely scenario is for prices to stabilize in some markets and drop slightly in other areas. They are unlikely to fall in broad-based fashion.

Even if prices lost half their recent growth, very few homes would fall within the $200,000.

Between 2020 and October 2022 (the most recent month for which data are available), sales prices increased 30% in the country, while some areas saw sales rise as high as 50%. For example, in Austin, Texas, sales prices increased 51% from $347,000 in 2020 to $525,000 in 2022. They rose 48% in Phoenix, AZ during this period, rising from $312,000 up to $462,000.

What if all national markets gave up half their 2020-22 steep growth? However, less than half of the 50 most populous markets would see homes below $200,000 threshold. Only 6% of the 50 most populous cities would have homes priced below $200,000. The average national sales price would remain at $294,000.

Click here to see a table showing the current median sales price and 2020-2022 growth rates for more than 600 locations across the country.

Hope for 2023 buyers

It’s not all about chasing your dreams of purchasing a home in the next year. The history of selling and buying homes in the United States shows us that even in difficult economic times, millions of people will succeed. However, optimists need to be realistic and not optimistic. You can anchor your expectations by knowing what headwinds might present. This will help you plan the type of planning that won’t let you get ahead of yourself.

Talk to a local agent about a realistic budget. To better understand how your mortgage payments will relate to other financial obligations, you can use the home affordability calculator.

There is good news for 2023. Sellers are no longer in control of the market. The reason why the market is more balanced is that demand has fallen due to lower mortgage rates. This allows for more negotiation on issues such as price, closing date and inspections. Buyers will need to be flexible, especially if they have a lower budget. Although a few hundred thousand might not be enough to buy a home in one of the most desirable markets, careful research in other areas and a willingness forgo certain “must-haves” can make homeownership more possible than a pipe dream.

METHODOLOGY NOTE

Zillow’s median sales price data includes all homes, single-family, condos, and cooperatives. This data was last accessed on January 10, 2023. The most recent figures for October 2022 were available at that time. To produce conservative estimates of annual growth, monthly median prices were converted into annual averages.