Your trip might not go according to plan in these times of staff shortages and extreme weather. Travel insurance is a great option if this happens. While an insurance policy cannot prevent cancellations or delays from occurring, it can reduce the financial burden in the event that something unexpected happens.

How do you choose the right insurance provider? Let’s take a look at AXA Travel Insurance to see if it is the right plan for you.

What’s AXA?

AXA, a French insurance company, provides services in 50 countries. There are many types of insurance offered by AXA, including travel insurance. These policies include coverage for baggage damage, trip cancellation, interruption, and emergency evacuation. Cancel for any reason coverage is also available.

AXA Assistance USA, part of AXA Group, provides services in the U.S. as well as globally.

AXA Travel Insurance Plans

AXA Assistance USA offers three types of insurance plans for travelers: Platinum, Silver and Gold. Nationwide Mutual Insurance Company, and its affiliates in Columbus (Ohio) underwrite the plans. These are the types of coverage that you can expect from each policy.

-

Silver: This plan offers 100% cancellation and trip interruption coverage, $25,000 for emergency sickness and accident medical coverage, and $100,000 for emergency evacuation and repatriation coverage.

-

Gold: This mid-range Gold policy offers 100% cancellation and 150% interruption coverage, $100,000 for emergency illness and injury medical coverage, and $500,000 for evacuation and repatriation coverage.

-

Platinum AXA Platinum travel insurance includes 100% cancellation and 150% trip interruption coverage. It also offers $250,000 in emergency sickness and accident medical coverage, and $1,000,000 in repatriation and evacuation coverage.

You can add Cancel For Any Reason coverage to your Platinum plan. This policy must be purchased within 14 days after you have paid the initial trip deposit. It will cover 75% of your prepaid, nonrefundable travel expenses.

You can get coverage for any pre-existing conditions as long as your first payment is made within 14 days.

AXA Travel Insurance Cost and Coverage

Let’s look at AXA’s plans and the costs for a 19-day trip in Indonesia for a 36 year-old Utah resident. It costs $1,500.

Silver

Limits and coverage for the Silver-level plan are:

-

Trip delay $100 per day with a maximum of $500

-

Trip cancellation policy: 100% of trip cost.

-

Trip interruption: 100% off the trip cost.

-

Baggage delay: $200.

-

Lost luggage: $150 up to $750 per article

-

Missed connection $500

-

Emergency evacuation: $100,000.

-

Unexpected death or dismemberment: $10,000 (or $25,000 if you are a common carrier).

-

$25,000.

Our sample trip costs $55.

The Gold-level Tier offers the following coverages and limits for $79:

-

Trip delay $200 per day with a maximum of $1,000

-

Trip cancellation policy: 100% of trip cost.

-

Trip interruption: 150% off the trip cost.

-

Baggage delay: $300.

-

Lost luggage: $1,500 up to $250 per item

-

Missed connection: 1,000

-

Emergency evacuation: $500,000.

-

Unexpected death or dismemberment: $25,000 (or $50,000 if you are a common carrier).

-

Medical expense and emergency: $100,000

-

Collision Damage Waiver: $35,000.

Platinum

AXA’s highest level of tier is Platinum. This plan includes:

-

Trip delay $300 per day with a maximum of $1,250

-

Trip cancellation policy: 100% of trip cost.

-

Trip interruptions: 150% of trip cost.

-

Baggage delay: $600.

-

Lost luggage: $500 per article, up to $3,000

-

Missed connection $1,500

-

Emergency evacuation: $1,000,000.

-

Unexpected death or dismemberment: $50,000 (100,000 for a common carrier).

-

$250,000.

-

Collision Damage Waiver: $50,000

-

Lose golf rounds: $500.

-

Lost skier days: $25 per day.

-

Pet Boarding Fees: $25 per Day (up to 5 days).

This coverage level costs $95.

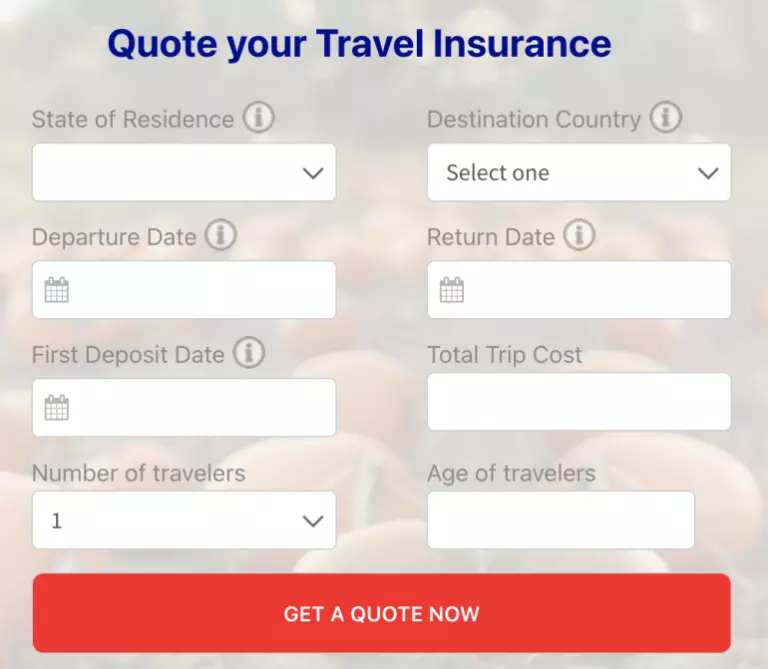

How do you get a quote for AXA

To get an AXA travel insurance quote, go to AXATravelInsurance.com and start by inputting your information in the quote box. Please enter your name, state, destination country, trip dates and deposit date. Also, please provide information about the total cost of your trip, number of passengers, and their ages.

After you have completed the form, click the “Get a Quote Now” button.

Three quotes will be displayed, one for each level of the plan. To learn more about each plan’s coverage limitations, make sure you click the “See More Benefits” link. The most expensive plans will have the highest coverage limits.

Pre-existing conditions waivers are available for the Gold and Platinum plans. To be eligible, you will need to purchase the plan within 14 calendar days of receiving your initial trip deposit.

The Platinum and Gold levels offer Schengen coverage and collision damage waivers. Platinum is the only plan that provides Cancel For Any Reason, so make sure you keep that in mind if your needs are more severe.

If you are looking for emergency medical or evacuation coverage, all plans have limits.

Tip

Squaremouth is a comparison site for travel insurance and a NerdWallet Partner. It allows you to compare plans from different insurance companies at once. Squaremouth allows you to compare multiple quotes from different insurance providers including AXA in one place, helping you choose the best plan.

Is AXA legal?

AXA was founded in the early 19th-century as a small insurance firm that specialized in property and casualty.

The company has changed names and acquired other insurance brands over the years, before becoming AXA in 1980. It is today one of the most important insurance companies in the globe. AXA is therefore a valid travel insurance provider.

AXA review of travel insurance recapped

Travel is the only thing that will make you richer. You don’t want your trip to go wrong. You never know what the universe will bring us so purchasing a travel insurance policy can help protect your investment.

AXA provides affordable, mid-range, and premium policies. They are simple to understand, offer adequate coverage, and don’t come at a high price.

Maximizing your Rewards

A travel credit card should be able to prioritize what is most important to you. These are our top picks for the best travel cards in 2022, as well as those that work best for: