Financial resolutions can be intentions such as “I want more money this year”, but financial goals are more specific. “I plan on cutting discretionary spending by 20% per month” is one example.

Financial actions are what you actually do to make progress. “I will log into and cancel any subscription I haven’t used in the last 30 days.” ”

The goal, according to Peter Bregman (executive coach and CEO at Bregman Partners, a executive coaching company).

He is a coach who helps leaders to focus on the important things. Because it is implicit, he says that people can overlook the intent of the change they wish to make. This can cause tunnel vision and inflexibility when it comes to achieving specific goals.

Don’t set goals and move straight from intention to action.

Let’s say that your financial resolution for 2023 (or financial intention) is to spend less money on debt. Bobbi Rebell, certified financial advisor and author of “Launching Financial Grownups”, says that you can say it loud to someone who will listen.

Money move 1 : Take a look at the numbers

Grab a recent paycheck, a piece paper or a budget planner. Rebell suggests that you write down your monthly after-tax income and then list out your financial obligations. Consider rent, utilities and groceries as well as child care and transportation.

Add these essential expenses to your monthly income. You can use the money you have left to save or for discretionary spending.

Rebell says, “It’s often not as bad as it seems.” She says that this exercise can reveal that many expenses are discretionary.

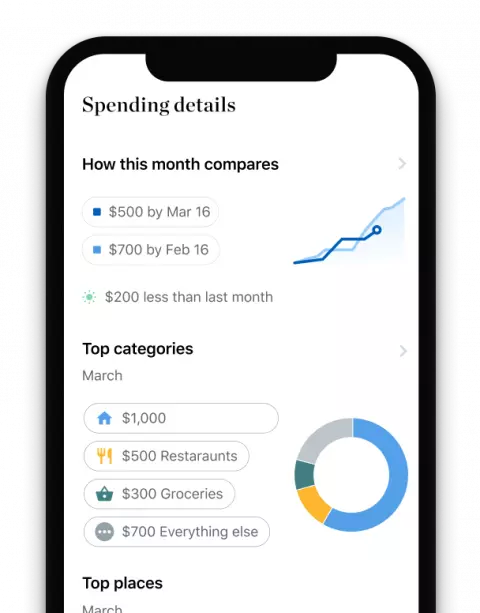

To track all your spending, you can use credit and bank apps. You will probably find some things you can cut. You can also use streaming services to save money if you aren’t sure where to begin. It may surprise you at how much joy it brings.

Find your savings opportunities

View your spending breakdown to see your top spending trends.

Money move 2 – Make it more difficult to buy items online

Spending is easy on the front end with digital wallets, debit cards, credit cards and cash apps. You’ll feel the dull pain when bills come due, especially if your credit card balance is high.

It is time to make shopping difficult. Rebell suggests that you delete retailer apps, unsubscribe to their mailing lists, and remove credit card information from websites and browsers. Although it may seem trivial, this adds friction to the purchasing process. If you need to take out a credit card and then hand the numbers to your phone at checkout, you’ll likely think twice about buying a new pair of shoes.

She says, “It’s basically an updated version of ‘freeze credit card in the freezer’.” Yes, it is possible to freeze your credit card.

Money Move 3: Choose an approach to paying down debt

Reexamine your obligations list and pay attention to the debt. Take note of the interest rate and amount that you owe for any money borrowed. You can think of these as student loans, car payments, or balances on credit cards. Choose a priority strategy.

To pay off your debts, you might consider using a debt snowball approach or debt avalanche. You focus on the smallest balances first and then work your way up to a quick win as you take out loans.

To eliminate the most costly debt, debt avalanche allows you to prioritize loans with higher interest rates. Due to their high APRs, credit card bills can be a good place for debt avalanche.

Both have their merits. It is important to choose a path and take the first step.

A new year, new financial goals

Set goals if they are what gets you from A to B. However, don’t let percentage targets stop you from taking simple steps to control your money.

Rebell says that even small steps can have a huge impact. Rebell advises that you do your best and not be too hard on yourselves.