The rule of thumb states that rent should not exceed 30% of a household’s gross income. This means that most cities in the United States are out of reach.

NerdWallet’s monthly rent-to-income ratio analysis for 225 U.S. cities shows that 65% of rents are equal or higher than the 30% recommended ratio in February. The ratio was 64 %.

Market rents in 57% of U.S. metro areas are considered moderately or severely burdensome. The Zillow data for market rent is based on February data. Data from the U.S. Census Bureau in 2021 was used to calculate this analysis. The data does not distinguish between incomes of residents who live in these cities and those who rent.

Federal standards dictate that a household must spend between 30% and 49% of its income on rent to be considered “moderately rent- burdened.” A household spending more than 50% means the household is “severely renting burdened,” according NYU Furman Center research. This center conducts research on housing and urban policy.

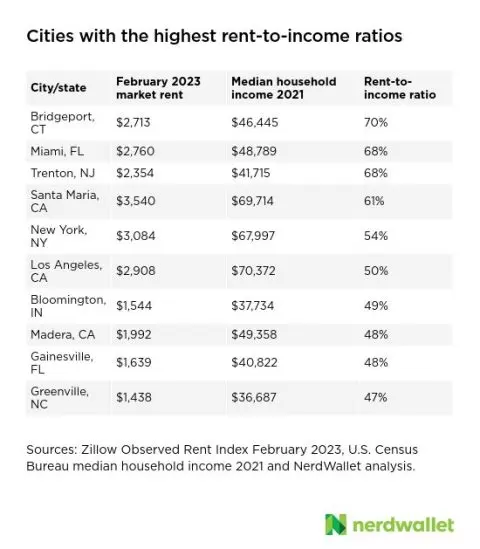

Six of the 225 cities that were analyzed have rent-to income ratios that place renters with median incomes within the “severely rental burdened” category as of February 2023.

-

Bridgeport, Connecticut: 70%.

-

Miami: 68%.

-

Trenton, New Jersey: 68%.

-

Santa Maria California: 61%

-

New York City 54%.

-

Los Angeles: 50%.

The most financially burdened people in housing are seniors, low-income households and immigrants, according to a 2015 Zillow analysis based on U.S Census Bureau data.

These are the most affordable and least expensive rental housing markets according to Zillow’s February 2023 rental market data.

Are rents rising or falling?

According to Zillow’s February 2023 rental report, 0.3% of the advertised rents rose between January and February. The average asking rent increased 6.3% over the same period last year.

Only eight of the 51 cities Zillow tracks on its monthly Observed Rental Index saw rent declines between January and February. The most notable decreases were in Cleveland (-1.03%), Jacksonville, Florida (–0.43%), and Salt Lake City, Utah (-0.35%). The 43 cities with the highest market rent growth between January and February were Hartford, Connecticut (1.27%), Sacramento, California (993%), and Chicago (0.78 span>

Since Zillow started tracking rents in 2016, the annual rent growth reached a peak of 17% in February 2022. It has slowly declined since then. Cincinnati had a 9.4% increase in rent over February 2022, which was the city with the highest average annual rent growth. The only city with a decrease in rent was Las Vegas, which saw a 1% drop in February compared to the previous year.

Rent is one of many factors that contributes to the measurement of inflation. The largest portion (34%) of the consumer price index (a proxy for inflation) is shelter. According to the CPI, shelter was responsible for 70% of the monthly inflation increase in February.

Current inflation is not necessarily indicative of current market conditions due to the delay in reporting rent data. This is due to the long cycle of lease renewals that lasts around one year.

Despite this lag, rent-specific inflation has outpaced overall inflation over the past decades.

Methodology: Rent-to-income ratios by metro area

NerdWallet gathered the most current market rental data from 495 cities in the Zillow Observed Rent Index. It then matched that data with the U.S. Census Bureau’s most recent median household income data (2021). Some cities that were identified in the Zillow Observed Rent Index didn’t make it onto the U.S. Census Bureau’s list of median household incomes per city. They weren’t therefore included in this analysis. Both sets of data identified 225 cities. NerdWallet then calculated the rent-to income ratio using the following formula. Market rent/(median earnings/12 months span>