Although setting financial boundaries can be daunting, it can help you get on the right track to financial health.

Are you having trouble setting financial boundaries?

What are the financial limits?

Aja Evans is a licensed financial counselor and mental health counselor in New York City.

Financial boundaries allow you to set clear expectations about how money will affect your relationships and how it will interact with you.

Examples of financial boundaries include:

-

Restricting your spending on wants and needs.

-

Telling someone not to borrow money.

-

Offer to pay a specific amount for someone instead of cash.

What are the financial limits?

Boundary setting can be a powerful skill. While it can be difficult to stand firm on your healthy financial limits, this skill can help you reach your financial goals.

“From positive psychology perspectives, we should consider setting financial boundaries to cultivate our ability to say ‘yes’,” says Michael G. Thomas Jr., lecturer at the University of Georgia with a doctorate of financial planning and an accredited financial counselor.

It is easier to say yes to things such as saving money for a house, going on vacation, or paying down your debt by setting boundaries with yourself and those who drain your funds.

Evans states, “It is important to understand how you feel when you cross a line. Having money boundaries can help you avoid feeling worse later.” For example, realizing that you have $400 per month to go out for dinner can be a great feeling. But if you spend more, it will likely make you feel awful span>

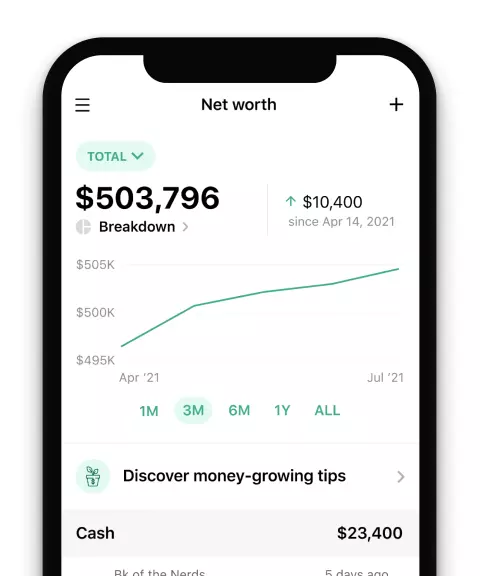

Track your money using NerdWallet

You can now see all of your accounts from one place, without having to log in to the bank.

6 ways you can set financial boundaries

These are some ways to get started.

1. Find out what is outside your comfort zone for money

Before you can establish any type of guardrails you must first define your boundaries.

Evans suggests that you “check in with yourself” and identify when you feel guilty about spending money. Imagine you and your friends go out for dinner and you agree to split the bill, but you end up spending more than you ate. Then you feel uncomfortable about how much you spent. This could be a good spot to set a money limit .”

You can track when you are being forced to go beyond your comfort zone by keeping track of money situations. This will help you identify the boundaries that you need. You should also allow yourself some indulgence when you set boundaries with others. It can be difficult to adhere to a diet plan if you are too strict.

2. Clarify what you want

Being clear about your goals and aspirations can help you to be more motivated.

Thomas suggests that you make a list of goals for the year. These can include more self-care and more travel.

He says that knowing what you want with your money will help you have talking points to communicate your goals.

3. Get started early

Sometimes it can be difficult to communicate when there is conflict.

Thomas states, “Start early and communicate money limits while things are going smoothly.”

It is better to address your concerns during peace, especially when you are not in the middle or at the beginning of a dispute.

4. Give context

It can seem almost like you are just saying “no” when you communicate a boundary.

Providing additional context about why you are setting financial boundaries may increase the chances of them being observed

Thomas says, “Once your list has been completed, you can share with people your excitement and hopes for the year.” People will be less likely to bother you if you share your goals with them. You’re not saying “no”, but you’re actually saying, “Here’s what you want to accomplish span>

5. Brand yourself

People who have been raised to be givers or dependent on their partners or friends may find it difficult to put themselves first when it is time to meet their financial needs.

Thomas recommends “rebranding” to change the roles you play in a relationship. While you don’t need to stop giving, you should be clear about the amount you are willing to give.

6. Prepare for pushback

Even if you provide context and communicate in a compassionate manner, your guardrails can cause tension between people. This is especially true when you have to meet cultural expectations.

Evans says, “As a Black woman my expectations of my white counterparts are often very different.” “My peers in communities of color are often expected contribute to their families.”

Be prepared for the possibility that boundaries may not always be respected and to have a plan in place for when they aren’t.

If you get pushback, try the following:

-

Don’t offer monetary assistance. You can think of ways you can help others, even if they don’t need your money.

-

Be firm about your boundaries and reaffirm your reasons for wanting them.

-

Discuss the consequences of not having boundaries respected. This could mean reaching out to less people or ending relationships.