Welcome to NerdWallet’s Smart Money podcast. Here we answer real-world money questions.

This episode discusses the upcoming Supreme Court cases regarding student debt cancellation.

Watch this episode on one of these platforms:

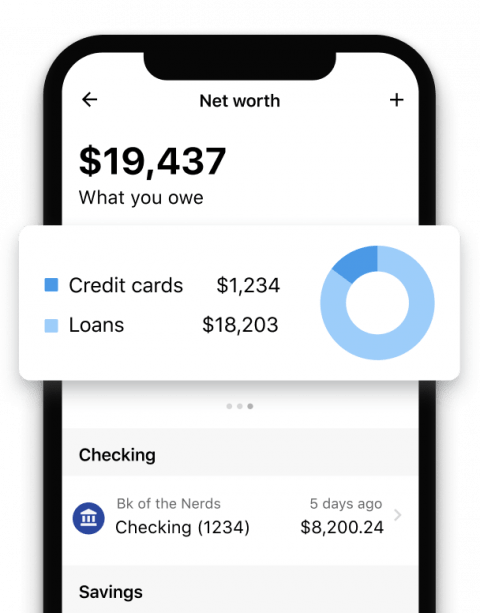

It’s time to get rid of your debt

Register to track and link everything, from mortgages to cards, in one place.

Our take

Two cases will be heard by the Supreme Court this month. They will decide whether federal student loan borrowers can have all or part of their student debt cancelled. The first case involves the argument that debt cancellation could harm state tax revenues and finances of state-based lending agencies. The second case concerns whether the Biden administration’s decision to cancel debt violates a federal law that requires public comment.

It is unknown where the Supreme Court will end up in these cases. They put in doubt the possibility of federal student debt cancellation. Regardless of the outcome, the Biden administration plans to have student loan payments resume this summer, regardless of what happens in these cases.

In light of current circumstances, it is a good idea for people whose loan payments were halted to plan to repay the balance. Remember that if you were refunded for payments you made during the pandemic, this amount would be added onto your balance.

You can get ahead of the payments by updating your contact information at studentaid.gov and your student loan servicer. This will allow you to receive communication about your loans. You should also know that there are new repayment options available. This repayment plan is income-driven and offers a greater range of repayment options. Check your budget to see how monthly loan payments would fit in your cash flow. Consider putting your monthly loan payment aside if you have the cash. This will allow you to put a bit of cash aside for your monthly loan payment when your payments resume. It will help you pay your loans off faster.

Learn more about student debt at NerdWallet:

Episode transcript

Sean Pyles: Will those of you who applied for relief from federal student loans to be cancelled ever see relief? The Supreme Court will hear our cases this month to determine our fate.

Anna Helhoski – Welcome to NerdWallet Smart Money Podcast. We welcome your money questions and will answer them with the assistance of our brilliant Nerds. I’m Anna Helhoski.

Sean Pyles: I’m Sean Pyles. You can call the Nerd hotline at901-730-6373 to ask a money question. That’s 901-730-NERD. You can email us at [email protected]

Anna Helhoski – Follow us wherever podcasts are available to receive new episodes every Monday. If you like what we hear, please leave us a review.

Sean Pyles: Anna. You’ve been covering the student loan cancellation controversy and the legal issues surrounding it for quite some time. Can you please tell us, for those who haven’t been paying attention to the ground, what’s happening right now?

Anna Helhoski: Sure. It may be recalled that President Biden declared last summer that federal student loan borrowers could receive up to $10,000 in student loan cancellation. For eligibility, borrowers would need to meet income requirements. This means that they couldn’t make more than $125,000 per person or $250,000 for married couples. If you meet these requirements, and have also received a Pell Grant at college, you could receive up to $20,000 in debt relief.

Sean Pyles : But, that income cap really complicated things.

Anna Helhoski, Yes, Sean. This meant that there would need to be an application process. Many people hoped that debt cancellation would happen automatically since it would have been difficult to pay off debts that were already paid off. The application was accepted. The application was made available to students in October. As you might imagine, applicants flooded the system. You might recall that Sean submitted his application within a matter of minutes on one of our episodes.

Sean Pyles: It was a great episode, and I look back at it now that I see how foolish we were to think that this would be the end of our relationship. I would submit my application within a few minutes and would receive debt relief very soon, hopefully.

Anna Helhoski: I know. It was simpler back then. As early as mid-November, relief was expected to begin for borrowers. Between the announcement and the 26 million applications received by the education department, several legal challenges were brought against the Biden administration. Two of these legal challenges stopped the process from moving forward, even though the education department had sent notices to 16,000,000 borrowers whose applications had been approved. Sean, have you ever received one of these notices?

Sean Pyles : At the time, I believed it was too good to be true. But, it turned out that maybe it was.

Anna Helhoski, So there were six lawsuits originally on the table. Two of them will now be taking to the Supreme Court this month.

Sean Pyles: This is a complete mess. Anna, could you please give us an overview of these cases?

Anna Helhoski: Okay, now hold onto your hats. Six states, including Arkansas, Iowa and Kansas, Missouri and Nebraska, claimed in the first lawsuit that Biden’s debt relief would hurt their tax revenue and state-based loans agencies. A Missouri federal judge dismissed the case on October 20th. However, the plaintiffs filed an emergency request for a temporary stay the following day. The Eighth U.S. Circuit Court of Appeals granted the motion. Circuit Court of Appeals granted the appeal.

Sean Pyles : But what about the second?

Anna Helhoski. Case number 2 was filed in Texas by the succinctly called Job Creators Network Foundation Legal Action Fund. It alleges that Biden’s debt relief violates an act of Congress that permits public comment on a rule. The lawsuit was filed for two plaintiffs: one is ineligible to receive debt relief due to her type of loan, and the other is not eligible for up $20,000 because he has never received a Pell Grant. It was also questioned if the executive branch had any authority to cancel debt under HEROES Act. This was the COVID early stimulus package. The Texas judge ruled against Biden’s administration. The White House appealed against the decision, but the Fifth U.S. upheld the original decision. Circuit Court of Appeals. Both cases prevent any debt relief from being granted as they progress through the system. Both cases will be heard by the Supreme Court on February 28.

Sean Pyles Although I don’t like asking for predictions, I wanted to know if you had any idea which side would prevail.

Anna Helhoski – Crystal ball questions are my favorite, because I don’t have to be right but each side believes that they’re right. While I have my thoughts and maybe biases about this, it is not clear where the Supreme Court justices will land on this matter. We will have to see how it plays out at the highest court.

Sean Pyles: Do your know when the decision will come out? Do you think it will be at the end of term or after all the cases have been heard?

Anna Helhoski: Nobody expects a decision to be made before June. Borrowers are no longer allowed to apply for forgiveness. These have been halted completely. Current guidelines say you can apply before December 31, 2023. However, I imagine that this could be extended if cancellations are allowed.

Sean Pyles I have a lot of student loans, and am hoping they get canceled. When would you expect me to start making student loan payments again?

Anna Helhoski. Biden has ordered an eighth extension to the student loan payment suspension that had been in place since March 2020. The pause will be lifted 60 days following the Supreme Court’s final ruling or, if the litigation continues beyond June 30, then it will be lifted 60 days later. It could happen on August 29th, which would mean it could take place 60 days after June 30, or even earlier in the summer.

Sean Pyles: I do remember this pause being extended many, many times. But this time, they are saying, “This will be it. No more extensions. ”

Anna Helhoski – I covered all of these extensions, and they always said “This is going be the last one guys.” This one does indeed seem to be the last, particularly if Biden continues with the May pandemic crisis relief.

Sean Pyles: I recall that during the pandemic, some people who had actually paid their student loans were able get refunds. What is the deal?

Anna Helhoski says: If you were among those who received a refund you will need to repay that amount if the debt cancellation is completed. If this happens, the new amount of your payment will reflect the refund and reflect the higher balance.

Sean Pyles: This is quite rough. It’s not looking so good for people who want to cancel their debt. So, how can they prepare?

Anna Helhoski: Do not count on debt cancellation. Instead, you should expect payments to restart. Here are some things you can do. Update your contact information on studentaid.gov and your student loan servicer. This includes your email address, phone number, and home address. You must be able contact you. You can also review the auto-debit enrollment process or contact your student loan provider to sign up. This will ensure that you don’t miss any payments. It might be worth looking into an income-driven repayment program that will make it easier to manage your monthly payments. The Biden administration has also proposed a new, more generous, income-driven repayment plan. However, it is not clear when that plan will become effective.

Sean Pyles: People might also want to review their budget and add the amount of your monthly student loan payments. See how this would affect your cash flow. It’s been so long that we have had to make monthly payments. If you are able to set aside some money now, you might be able to make a large lump sum payment once these payments resume. You’ll still be able to make some progress on your balance.

Anna Helhoski Now is a good time for you to reevaluate your budget.

Sean Pyles Anna, I noticed that there is nothing in this article about sharpening your pitchforks.

Anna Helhoski: Not quite yet. Although I am sure that protestors from both sides will gather outside the Supreme Court within the next few weeks, I believe it is safe to just wait.

Sean Pyles Thanks for the information today.

Anna Helhoski: You got it. You can call the Nerd hotline at 901-730-6373 to ask any questions regarding student debt cancellation, or anything money-related. That’s 901-730-NERD. You can also email us at [email protected] Visit nerdwallet.com/podcast for more info on this episode and remember to follow, rate and review us wherever you get this podcast.

Sean Pyles: The episode was produced jointly by Anna and me. Tess Vigeland was our editor. Our audio was edited by Kaely Monahan, an audio wizard. We want to thank everyone at the NerdWallet Copy Desk for their assistance.

Anna Helhoski: Let’s start with a disclaimer. We are not investment or financial advisors. This Nerdy information is intended for general entertainment and educational purposes only and may not be applicable to your particular circumstances.

Sean Pyles