The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Welcome to NerdWallet’s Smart Money podcast, where we answer your real-world money questions.

This week’s episode features a roundtable discussion of Nerds reflecting on the financial impact of the COVID-19 pandemic.

Check out this episode on any of these platforms:

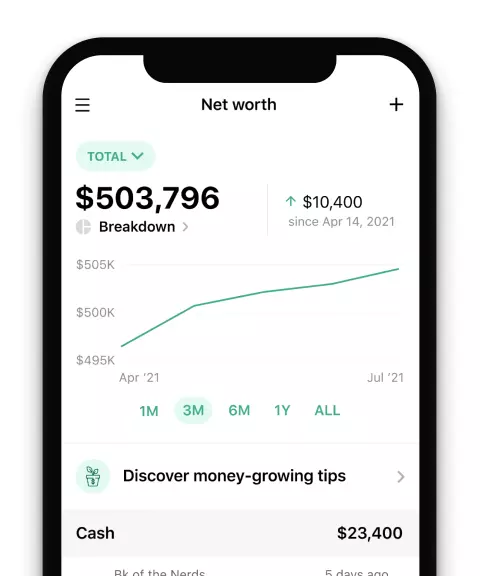

Track your money with NerdWallet

Skip the bank apps and see all your accounts in one place.

Our take

The COVID-19 pandemic seemed to touch every corner of our lives and especially our finances. Some of today’s pressing economic issues, including inflation and the competitive housing market, have their roots in the pandemic, proving that COVID-19 isn’t finished with us yet.

In early 2020, Americans were able to save more money than ever thanks to government stimulus checks. However, spending levels today are lower than they were before the pandemic, partly because of the increased price of goods and services.

Massive unemployment was another product of the COVID-19 pandemic. According to the Bureau of Labor Statistics, the unemployment rate hit 14.7% in April 2020 before coming down to 4.8% in September 2021. Now, the country has largely opened back up, and unemployment is lower than it has been in over 50 years.

The stock market plummeted in March 2020, taking many Americans’ retirement funds with it, but it recovered to hit a high in December 2021. As of the first quarter of 2023, though, the stock market remains below 2021 levels in response to the Federal Reserve’s efforts to fight inflation.

Those looking for a house today may come up empty-handed as the housing market remains impacted by the 3-year-old pandemic. When mortgage rates were below 3% from September 2020 to September 2021, a record low, many homeowners refinanced. But after the Fed raised interest rates eight times since the beginning of 2022, mortgage rates steadily increased, discouraging homeowners who locked in low interest rates a few years ago from putting their homes on the market. With fewer homes for sale, existing home prices remain high.

More about the financial impact of COVID-19 from NerdWallet:

Episode transcript

Sean Pyles: Do you remember where you were three years ago when the world started to shut down? When states across the country began telling citizens to shelter in place for an indeterminate amount of time? When there was a run on toilet paper and Clorox? Welcome to NerdWallet’s Smart Money podcast. I’m Sean Pyles. On this episode, we’re hosting a roundtable discussion to reflect on how our lives financially and personally have changed since the onset of the COVID pandemic in March of 2020. President Biden plans to end the national and public health emergency declarations that have been in place for the last three years on May 11. So we wanted to take a look back at the effect of this global upheaval on all of our finances, from where we live, to how we work, and what we spend our money on, and what all of that tells us about the finances of the future. Joining us in this conversation are NerdWallet investing writer Arielle O’Shea. Welcome, Arielle.

Arielle O’Shea: Hi, thanks for having me.

Sean Pyles: And mortgage Nerd Holden Lewis. Great to have you back on the show, Holden.

Holden Lewis: Hey, guys.

Sean Pyles: Also with us, NerdWallet data writer Liz Renter. Hey, Liz.

Liz Renter: Hey, Sean. Happy to be here.

Sean Pyles: I’m curious, anybody have any quick takes on what you remember about this time three years ago, especially anything having to do with your money as we were all kind of in this bizarro world where we had no idea what was happening? Arielle, let’s start with you.

Arielle O’Shea: I have three little kids, so I think I’ve kind of blocked out most of my memories. It was total chaos in my house. I just remember trying to work and entertain them and put them in front of Zooms while I was also in front of Zooms and things like that. I definitely threw a lot of money at the problem. I definitely ordered pretty much anything from Amazon that I thought might capture their attention. None of it actually did. But I also remember feeling incredibly lucky that my husband and I were working. We had jobs that we could do from home. We didn’t have to worry that our paychecks would be affected. Then also just as an investing editor at NerdWallet, watching the effect on the stock market, that dramatic crash in March 2020 and the really fast recovery was really fascinating.

Sean Pyles: Holden, what about you?

Holden Lewis: When the shutdown started and a lot of people stopped getting paid, I wondered if the government would finally have some common sense and do whatever it took to prevent foreclosures and evictions, because they fell short after the 2008 financial crash. I was pleased to discover that the federal government and some state governments really did learn some lessons from 2008. They imposed foreclosure and eviction moratoriums. They made sure that landlords and mortgage bondholders would get paid and wouldn’t go broke and out of business. The federal government can print money and throw it at problems, and in the past they’ve been hesitant to go far enough. This time they probably actually went a little too far, added too much money to the economy, which contributed to high inflation. The way I look at it is there’s drawbacks to inflation, but it really does beat a severe recession or deflation. Or as I like to think about it, I would rather have a job and be complaining about the price of eggs than not have a job and not be able to afford eggs at all.

Sean Pyles: That’s a good point.

Arielle O’Shea: True.

Sean Pyles: Liz, what about you?

Liz Renter: I think primarily I would just echo Arielle in that I had this overwhelming sense of gratefulness. I’d worked from home for over a decade at that point. I didn’t have to all of a sudden try to figure out how to work in a house and skip the commute and deal with kids because I didn’t have any at home. So there were many reasons that I was thankful, but one of the scenes that I will probably never forget is moving my daughter out of her freshman dorm. It was the spring of her freshman year. They all went out on spring break and then were told don’t come back. Then when they did go back a couple months later, it was to get all of their stuff. When I went to go move her, they were letting one family on each floor at a time to move them out and these rooms were these little time capsules where these kids had left on spring break and never came back.

It was only nine months earlier or less that I had been moving her in there amongst crowds of families and tears, and it was this celebration and now the stark difference was really troubling. Then it gets you thinking, what about the kids, these 18-year-olds who don’t have a family home to go back to, who are there maybe on scholarship and are probably panicking? I remember seeing some news stories about kids in those situations, but that feeling in that dorm room when it was empty is definitely something I won’t forget.

Sean Pyles: Sounds very somber and kind of surreal in a way.

Liz Renter: Right. How about you, Sean?

Sean Pyles: Well, like any good American in a crisis with money to spare, I joined the masses of folks who were just buying a bunch of stuff online. My partner and I got really into gardening and landscaping. I also bought myself a velour tracksuit that I dubbed my pandemic uniform. I still wear this thing all of the time. That’s all to say that like you guys, I was pretty privileged. I largely viewed my role during the early stage of the pandemic as to stay out of the way of the world and not get this thing any worse than it already was and basically let time pass.

Well, let’s talk about some of the ways that our day-to-day life as a consumer have changed since March of 2020. For starters, we’re not washing our groceries anymore, which is nice and very glad that period was pretty short-lived. But Liz, what do the numbers tell us about, for example, things like our savings and spending habits?

Liz Renter: That’s a great question. You can look at any number of economic data sets for the period over the past three years and see a lot of big swings in one direction and then big swings in another direction as things sort of try to find normal. I think the saving and spending habits is really — those are two really good places to look at. The personal saving rate is a number that is published by the Fed, and essentially it’s the difference between our personal income and how much we spend every month. If you look at this data set of the personal saving rate, before the pandemic, it was hovering around 7% and had been for quite some time. But come April 2020, it jumped to a record high of 33.8%, and that coincided with the first stimulus payment.

Then you could see it tick down a little bit, and then two more jumps: 20%, and another one at 26.3% as the next two stimulus payments came in. So now the most recent number is 4.7% and if you were listening, you realize that that’s lower than pre-pandemic. Now we have people’s finances are starting to be constrained again, and inflation is pushing it down even further because we’re having to spend more on the things we buy every month.

Sean Pyles: Also, the things that we have been spending our money on have changed over the past three years as well, right?

Liz Renter: Exactly and so looking at spending patterns over the past three years is really pretty interesting. A couple of you guys mentioned early in the pandemic how much you were spending on goods to make home comfortable, to occupy your kids, to outfit the home office or any number of things. People were blowing a lot of money on goods, but not on services. They weren’t going to the movies, they weren’t going to restaurants. These places were closed or if they were open, a lot of us were opting out anyways. Once businesses came back online and restaurants reopened, that sort of switched and goods spending came down and service spending went through the roof. Spending on services is still pretty high and the demand on services paired with shortage of labor in the service industry, and a couple other things, are part of what’s making our current inflation difficult to tame is that demand for services now is still quite high.

Sean Pyles: Well, that brings me to my next question. If you look back at the last three years, one of the things that really stands out to me is the dramatic pendulum swing of fortunes in the job market. Millions of people lost their jobs in this first few months of the pandemic, and then we launched into an insanely hot job market that had people quitting left and right, that so-called “great resignation.” Now there’s this perception that we’re in layoff land even as the unemployment rate is actually quite low. Liz, what are your thoughts on that wild journey?

Liz Renter: There’s a lot going on in the labor market and over the past three years, to your point, it’s seen sort of a lot of extremes. First off, the layoffs we’re seeing now are largely isolated in the tech industry, some in the media industry, but they’re isolated. Layoffs in general across the country are pretty low. Unemployment is very low. We’re in what they call a tight labor market. There’s plenty of jobs and there’s not enough workers to meet those needs. But it wasn’t that case three years ago, right? Unemployment hit 14.7% in April. April 2020, that is. Well, unemployment came down and when it first came down and came down dramatically, I think you guys will probably remember every store had “help wanted” signs. Everybody was looking for help. Then businesses were shutting down not because of the pandemic directly, but because they couldn’t staff.

Things have improved since then, but the labor market is still very tight. There are still about two jobs available for every person looking for one. For workers on the lower earning end of the spectrum, wages have gone up. And this is good news, more money is good news on your paycheck, but you’ll hear in the news economists and the Fed talking about, “Oh, we need to get that wage growth in.” So what do they mean? Do they not want us to make more money? No, they do, but higher wages can lead to inflation, and so effort to get that inflation down, that’s why you’re hearing them talk about wage growth.

Sean Pyles: Well, Arielle, let me turn to you now and get your perspective on what’s happened in the investing world. Back in March of 2020, we saw a massive downturn in the stock market, but then record highs by the end of that year. So if folks dumped out at the start of the pandemic, they might have missed the big run back up, and now over the past 12 months, investors have been dealing with significant losses. Is this yet another opportunity to remind folks about the folly of timing the market?

Arielle O’Shea: It almost never pays to sell during market crashes or even during periods of market volatility, especially if you’re doing it in a panic rather than part of a really well-thought-out plan. There aren’t a lot of decisions that are best made in a panic. There were some people at this time who felt like they really needed to tap their investments — maybe they’d lost jobs or they feared they were going to lose them soon, so there was a huge emotional component to this. But in hindsight, we can say it underscores the importance of an emergency fund, keeping your short-term money out of the market. But the pandemic was such the definition of the unexpected, and people really didn’t know how to react, so they wanted quick access to their money, which is totally understandable.

Sean Pyles: It felt like everything was unraveling, so people wanted to get their cash and hold onto it.

Arielle O’Shea: Right, exactly. I mean, I think there were people who were worried that they wouldn’t be able to access ATMs even and things like that, so it all totally makes sense. But investing is always going to reward patience, and we saw such a quick and dramatic recovery. As you said, the market was hitting records by the end of the year, and so people who did pull out because of fear and not because they really needed that cash probably really regretted it. People who had extra money during that time in March 2020, and they saw that crash as an opportunity, got a lot of benefits from it.

Sean Pyles: Well, I also have to bring up the curious meme stock days of 2021, which happened while a lot of people were stuck at home, possibly playing with the savings that we talked about earlier, having too much time to spend on their smartphones. What do you think was the primary lesson coming out of that short-lived investing era of sorts?

Arielle O’Shea: It was so funny. I was just talking to one of the editors on my team about this, and he brought up the point that in 2019 — the end of 2019, so right before the pandemic kicked off — the online brokers all dropped their trading commissions to zero, making it free to trade stocks. So I think that kind of added into this perfect storm where investing was much more accessible, not having to pay made it a lot more impulsive, and then some folks really ended up with extra time, extra money due to the pandemic, and all of that played into the meme stock craze. I think ultimately we know that timing the market, engaging in complicated strategies like short selling and definitely following investing trends on platforms like Reddit probably isn’t going to get most people any further than really boring strategies.

Boring is almost always better, and that means doing things like dollar cost averaging into retirement accounts — which you’re probably already doing if you have a 401(k) — and then investing that money into low-cost index funds, ETFs, things that really just sort of track the performance of the market, and you’re not taking bets around whether something’s going to go up or down.

Sean Pyles: Well, Holden, I got to ask you, did you make any money in the meme stocks? Are you retiring earlier or anything like that?

Holden Lewis: Oh, I’m sorry. Is that you, Sean? You sound just like my butler. Butler, another virgin colada, please. OK. Excuse me. No, boy, I am definitely not a meme stock person.

Sean Pyles: Well, that’s fair. Well, let’s move on to your area of expertise, which is the housing market, and it’s seen the same kind of wild swings as the job market and the stock market, and in 2021 saw a housing boom that actually started in late 2020. And then last year, 2022, as the Fed hiked interest rates, mortgage rates quickly followed and it became a buyer’s market with sales slowing way, way down. Is it fair to say that most of this market movement has been because of interest rates or is there something else at play here?

Holden Lewis: It mostly has to do with interest rates. That and human nature. Let me explain. First of all, the Fed cut short-term interest rates to near zero in March 2020. Now, there’s not a direct line between those short-term rates and mortgage rates, but eventually mortgage rates did fall. They reached record lows and the 30-year mortgage stayed below 3% from September 2020 to September 2021. So that’s where human nature fits in. People buy houses based on the monthly payments they can afford. They don’t really care so much about the real prices — it’s that monthly payment. With mortgage rates so low, they could afford to bid up prices, and that’s exactly what they did. People engaged in bidding wars because they knew rates wouldn’t stay that low forever. It was time to buy now, so that’s what they did. Then the Fed, they jacked up rates in 2022, and suddenly a lot of buyers found homes unaffordable because of that combination of higher mortgage rates and inflated prices.

Then that’s where human nature pops up again. Millions of homeowners refinanced when mortgage rates were below 3%. When rates went up last year, those homeowners looked around and they said, “I’m not going to sell my house, ever, even if the place is small because my family’s growing or it’s too big because the kids have moved out. Because if I sell it, I’m going to have to pay a much higher interest rate on the mortgage of the next house I buy. At these interest rates, I can’t afford a home that’s nicer than the one I have now.” That’s the conclusion that a lot of today’s homeowners made. So now we have a very low inventory of homes for sale, and that means it’s not really a buyer’s market, at least east of the Rockies. Prices have been falling in expensive markets on the West Coast, but they’ve still been going up slowly in much of the country because there’s just simply not enough homes available to meet demand.

Sean Pyles: Well, during the pandemic, were people also looking for different types of homes compared to before the pandemic potentially, and has that changed coming out of the pandemic?

Holden Lewis: Well, we heard a lot about people in cities buying homes in suburbs so they could live in those suburban houses, which just tend to have more room for home offices, for in-home classrooms. On top of that, a lot of young adults moved back to live with their parents in the suburbs. Admittedly, that was more commonly for financial reasons than to enjoy spacious accommodations, which, OK, kind of makes me think about you because didn’t you buy a house during this pandemic?

Sean Pyles: I did. I used the money that I got from the stimulus checks to build up a down payment for a house in rural coastal Washington, and part of the idea was that it would be a getaway spot, and I would not have bought anything that remote if the pandemic didn’t happen, in part because I just simply wouldn’t have had the money. But it was a time of wanting to feel more secure in my home space and also I had this cash and I figured I might as well use it. The market was so hot — it seemed like the best time to jump in. But I want to hear from you guys, too. Did any of you refinance or buy a new house during the early days of the pandemic?

Arielle O’Shea: I refinanced my existing house.

Sean Pyles: What interest rate did you have before and what did you get after?

Arielle O’Shea: I think it was 4% before I bought it in 2017 and now — I should know this. I work at NerdWallet. I want to say it’s 2.87%.

Sean Pyles: Oh, nice percent.

Arielle O’Shea: Which is pretty sweet. I’m never moving. I’m one of those people that Holden just talked about. Like, “Bury me here.”

Sean Pyles: Liz, didn’t you buy a really old house during the pandemic, or did you have that before?

Liz Renter: No, I bought during the pandemic, and I think we’ve talked about it on the podcast before, but it’s been a while. I bought in — it’s a small town, but we might as well call it rural Kansas. You can hear the cattle trucks roll by sometimes when I’m talking on the microphones. But I bought a big old house in the middle of the country and my interest rate is right at 3%.

Sean Pyles: Holden, what about you?

Holden Lewis: We did not refinance, partly because I inherited a house and we developed this plan to eventually move to that house, which is in Texas. I live in South Florida now, but we haven’t made a ton of progress on that because now I’m ambivalent kind of about moving to Texas instead of the mountains in North Carolina. But we’re just trying to figure out what the next step is.

Sean Pyles: Well, back to the kind of overall economy, which has really seen feast and famine. It seemed to come roaring back in 2021, then inflationary pressures hit in 2022, and there’s been talk of a possible recession, though that has yet to officially manifest itself. Liz, is it me or have these changes in fortune come really fast?

Liz Renter: It does seem to have happened all very fast and dramatically. But I mean, really the past three years are kind of a blur.

Sean Pyles: Yes.

Liz Renter: In many ways it’s very, very fast, but also very slow. But some of that speedy recovery, I mean, that’s good and it’s on purpose. Holden mentioned this earlier, but the federal government funneled massive amounts of money into that economy to get us out of that initial recession in 2020. The small-business support, the stimulus checks, expanded unemployment, this was all by design, and it worked. It was the shortest recession on record, but the result is it helped lead to the growing pains we’re having right now. The same way we saw those stimulus checks boost people’s savings, that savings dwindled quickly for a lot of people. For people like me, I didn’t need a thousand dollar check. I could put that in the bank and just forget about it.

But lower income people were in need of those funds, in dire need of those funds. They used those for groceries, they used those for rent — they were gone quickly. This influx of money into the economy in many ways is no longer in the hands of the people that needed it the most and I think it’s important to remember that as we sort of work our way back to quote unquote normal, we need to remember that that normal or where we end up is still going to be much, much harder for some people than it is for others.

Sean Pyles: All right. Well, I have a question for all of you now. Has financial advice changed because of the pandemic, or are the basics always the basics regardless of global crisis? Arielle, what do you think?

Arielle O’Shea: I think in the saving and investing space, the basics are kind of always the basics, but the pandemic really underscored some of that basic advice. I’ve been writing about personal finance for a long time, and whenever I write about emergency funds, I give some examples. Like your roof might leak, your car might break down. Never have I thought to give an example of a pandemic, because I never thought that would happen. But it’s like this really dramatic example of the fact that the unexpected, the really unexpected can happen —

Sean Pyles: Will happen.

Arielle O’Shea: And having a foundation in place — will happen, right, we know that now — and having that foundation can make a huge difference. It’s always easier said than done for lots of the reasons that Liz just discussed. But I think things like keeping your expenses affordable when you can, using opportunities, any sort of extra money, to build that emergency savings, keeping short-term cash on hand means you don’t have to pull out of the market when it’s crashing. You can weather a sudden job loss or a drop in income. So I think if anything, this pandemic is a really good opportunity to remind people of that advice, especially now it’s tax refund season and so a lot of people get that refund, and that’s a chunk of money that can give you a good start toward these things.

Sean Pyles: Well, Holden. Let’s go to you on this. Any larger thoughts on housing or anything else finance related three years in?

Holden Lewis: Sure. Inspections during all these bidding wars in 2020 and 2021, people were forgoing them, and it’s just never a good idea. Now inspections are back, and I hope they never, ever go away. On top of that, I really hope that home buyers are becoming more thoughtful about the amenities that they really want. I watch some of these home shopping TV shows, and everyone is always talking about buying a home that’s ideal for entertaining. They want to have this big open space. They like open concept, which just like, I’m sticking my finger down my throat because I hate the open concept. I just go, “Who entertains that often?” I’m a hermit. I’m a homebody and I think a lot of other people are, too. So why don’t they buy homes where the residents can find some peace and quiet to work, to do homework or watch TV?

Arielle O’Shea: During the pandemic I moved into my bedroom closet as an office because my house does not have any doors. It is so open. Now I have a new puppy, and we cannot contain her. I want all the doors.

Holden Lewis: Liz is in this old house that probably has tons of separate rooms.

Liz Renter: It’s like a maze. There are so many doors.

Sean Pyles: Well, Liz, what about you? Do you have any thoughts on changes in personal finance advice?

Liz Renter: I think, honestly, I would echo what Arielle said again. I think I did that earlier, but really the pandemic underscored the importance of some of the basic advice. For me, the big one has always been — personally, I’m not just speaking professionally here — is the value of an emergency fund. I think a lot of the advice can stay the same, but there just needs to be more underlying and exclamation points. Now we have examples to point to where before I think it was all very hypothetical and like, “Well, this could happen and you could be unprepared, but now it’s like, ‘Remember three years ago when everybody you knew was out of a job?'” OK, that’s what we’re talking about here.

Sean Pyles: On my end, having hosted the podcast throughout the pandemic, I agree with a lot of what you all have said. The basics are the basics, but for me, the specifics of what to focus on in your financial life can depend a lot on what’s happening in the broader world and the economy. If interest rates plummet, great time to refinance a mortgage. Then if they’re shooting back up, better make sure you have a good high-yield savings account, that sort of thing. I have one final question for you guys. What about more broadly how people view the role of money in their lives? We saw a lot of people leave jobs that they decided were no longer good for them. People decided they want to travel more even if they couldn’t for a couple years. People making different decisions about how they use, make and spend money because of COVID-era epiphanies. Any predictions on whether those epiphanies will lead to lasting change? Liz, what about you?

Liz Renter: I kind of hate to admit this on such a wide scale, broad scale here, but I’m a cynic when it comes to long-term changes in human behavior. It’s hard to change who you are. The way we act with our money is often a product of years and years of repeated behavior. I’d like to be proven wrong, though. I think the default is to fall back into old patterns once the life-changing shock of something has worn off, but if a global pandemic has shifted your perspective, so you think about your financial life in a different healthier way, I think you should set up guardrails to fight to hold onto that.

Sean Pyles: I have to say I’m more of an optimist. I think if people experience a huge change in their lives and they want to adjust from that, shift their behaviors and make a better life for themselves accordingly, that if people are really dedicated and they want to change and improve, then they can do that. But that’s just me. Holden, are you feeling cynical or hopeful?

Holden Lewis: I guess it’s kind of a combination. Liz talked about people kind of reverting to older ways of behaving, and I think that with homeownership, maybe we’re going back to a more traditional, pre-20th century way of looking at homeownership. What I mean by that is that all my life I’ve heard that a home is an investment. I don’t think that’s the way people have viewed it, say, in the 17th century. Younger generations, they’re just not swallowing this homeownership as investment thing uncritically. I mean, yeah, it’s partly an investment, but a house is mainly a physical item that you use. I mean, it’s like a car. It eventually wears out and it has to be fixed up or torn down and there’s increased recognition of this, especially among younger millennials and Gen Z.

So my hope is that they’re going to be more thoughtful about whether they’re in a buying situation or a renting situation, and they’re just going to realize that homeownership is part of an entire life, an entire lifestyle in which they might choose to be more mobile and be a renter and be able to move more easily or settle down and be an owner.

Sean Pyles: Especially at a time when houses can be so unaffordable, people are better off renting in a lot of cases.

Holden Lewis: That’s right.

Sean Pyles: Well, Arielle, what do you think about these epiphanies? Do you think they’re going to last, especially as it pertains to investing?

Arielle O’Shea: I think I’m more hopeful than cynic. I think people are being more thoughtful about how they spend their money. I’m seeing signs that they seem to be prioritizing experiences, and maybe that’s because we didn’t get enough of them during the pandemic, and we learned sort of how valuable they are. But I see that in my own decisions and things that I’m reading. I think that ties into people valuing their time more and they’re being willing to leave jobs like you noted, or take risks, because we saw really firsthand that a lot of things aren’t guaranteed, that things can change at any moment and so we want to sort of be a little bit more mindful about how we spend our time and our decisions that we make with our money.

Holden Lewis: I got to totally agree with that because I think about how in the 10 years before the pandemic, I’ll bet I spent much less on concert tickets than I had, say, in the last two years. It’s kind of like, “Hey, now I have the opportunity to watch live music. I didn’t for two years, and man, I am going to go for it now.”

Arielle O’Shea: It feels like such a privilege, right? It’s all kind of new again, and eventually that’s going to wear out, but for now, it feels really special.

Sean Pyles: I feel like each year since the first year of the pandemic, there’s been a different big focus. In 2021, after getting my vaccine, I visited with a lot of family members. I traveled a lot. This year, similar to you, Holden, I’m all about doing more things locally, going to museums, going to concerts in particular too, and just trying to make the most of the limited time that we do have. All right. Well, I want to thank all of you for talking with me today. Arielle O’Shea, Holden Lewis and Liz Renter. Thanks so much for your insights and now I think we’re all prepared for the next pandemic, at least financially.

Arielle O’Shea: Oh, gosh. No.

Holden Lewis: No.

Arielle O’Shea: No. Or not.

Sean Pyles: Or maybe not. This is a time to say that we’re actually still in this COVID pandemic, so —

Holden Lewis: We definitely are.

Arielle O’Shea: We’re not ready.

Sean Pyles: All right. Well, that is all we have for this episode. To send the Nerds your money questions, call or text us on the Nerd hotline at 901-730-6373. That’s 901-730-NERD. You can also email us at [email protected] Visit nerdwallet.com/podcast for more info on this episode and remember to follow, rate and review us wherever you’re getting this podcast. This episode was produced by Tess Vigeland and me, Sean Pyles. Jae Bratton wrote our show notes. Kaely Monahan mixed our audio, and a big thank you to the folks on the NerdWallet copy desk for all their help. Here is our brief disclaimer. We are not financial or investment advisors. This nerdy info is provided for general educational and entertainment purposes and may not apply to your specific circumstances. With that said, until next time, turn to the Nerds.