Welcome to NerdWallet’s Smart Money podcast, where we answer your real-world money questions.

This week’s episode features a conversation with author Joe Saul-Sehy about making managing your finances fun. Personal finance Nerd Kim Palmer talks with Saul-Sehy about techniques for budgeting, saving and paying off debt that don’t have to be a drag.

Check out this episode on any of these platforms:

Before you build a budget

NerdWallet breaks down your spending and shows you ways to save.

Our take

Contrary to popular belief, you can have fun while tackling the seemingly boring tasks of money management. Whether you’re building an emergency fund, paying off debt or setting big financial goals, it’s possible to find the joy in it. Joe Saul-Sehy, co-author of the book “Stacked: Your Super-Serious Guide to Modern Money Management,” shows us how with some easy-to-apply tips.

He cautions against saving so much for the future that you forget to enjoy your hard-earned cash today. Similarly, he says all money goals should come with a timeline attached or else you can keep pushing them further into the future and never achieve them.

Saul-Sehy also embraces the art of laughing at his own money mistakes, something his followers can benefit from, too. He shares how he ruined his credit as a young college student but eventually recovered, years later. He might be finding the humor in personal finance, but his tips can lead to serious financial benefits.

Our tips

-

Prioritize building an emergency fund. Whatever else is on your financial to-do list, building an emergency fund probably deserves a place near the top. An emergency fund can help when you face unexpected expenses or income drops. Try to set aside at least $500, which could go a long way toward providing extra financial security.

-

Set money goals with timelines. Giving yourself a deadline, even an approximate one, helps you decide where to store savings as they build. For example, if you’re saving for something like retirement decades in the future, then you might choose to take on more risk and invest in the stock market, whereas savings for a short-term goal like next year’s vacation probably belongs in a safer spot, like a high-yield savings account.

-

Forgive yourself for money mistakes. No one’s perfect, but that doesn’t stop us from dwelling on errors. Whether it was overspending or ruining a credit score, think about how you can move on, making better choices going forward.

More about managing money on NerdWallet

Episode transcript

Sean Pyles: Welcome to the NerdWallet Smart Money Podcast. I’m Sean Pyles. We have a special episode in store for you today. Regular Smart Money guest and personal finance Nerd Kim Palmer is kicking off the next episode in our book club series where she talks with authors of personal finance books about their advice for how you can manage your money. Kim, welcome back to Smart Money.

Kim Palmer: Thank you. I’m excited to be here.

Sean Pyles: Yeah, who are you talking with this episode?

Kim Palmer: I am speaking with Joe Saul-Sehy. He’s the co-author of “Stacked: Your Super-Serious Guide to Modern Money Management,” and he’s also the co-host of the podcast “Stacking Benjamins.” He’s a former financial advisor. As you can probably tell from his book’s title, Joe manages to really find the humor in personal finance advice, and he also has some really solid tips to share with us.

Sean Pyles: Great. Yeah, well, I love that title. Perfect. Well, I will let you take things from here.

Kim Palmer: Great, thank you. Joe, welcome to Smart Money.

Joe Saul-Sehy: Kim. It’s so great to talk to you. Thank you very much.

Kim Palmer: Yes, of course. So you wrote a personal finance book. You, of course, host a popular personal finance podcast, and you’re a former financial advisor. So I first wanted to ask you, how did you get into this field?

Joe Saul-Sehy: It’s so funny; I got into this field because a friend of mine called me and said, and this is a quote, Kim, he said, “We normally don’t hire people like you, but I think you’d be good at this.” He was a friend of mine working for a financial planning company. Of course, this is the early ’90s. I’m an older guy, and it was mostly sales, and also he knew that I was interested in this topic and I grew up in a really small town in west Michigan. But as I learned all this salesy stuff that some of these quote “professionals” use, I would also do my homework every chance I got because I didn’t want to be embarrassed. I didn’t want to give people bad advice. And I at the same time went from being a complete money disaster myself when I began to actually being somebody that was very good with money.

Kim Palmer: Well, your mom actually comes up a lot in your book, and I think you record your podcast in your mom’s basement. I thought maybe you were going to say she was your first money teacher. Did she talk to you about money?

Joe Saul-Sehy: I grew up in a family a lot like many American families and really families around the world where we talked a lot about hustle. We talked a lot about being a good co-worker, about being a good employee, about being somebody that people would want to be around. But whenever it came to money discussions, if she and my dad were having a discussion, my brother and sister and I were told to leave the room, and I don’t think I’m alone there. I think that’s a lot of people. It’s strange that people can share in polite company this rash that they have on their arm and nobody blinks. But if you start talking about money, we don’t want to have that discussion. So unfortunately, no, Mom didn’t talk a lot about money.

Kim Palmer: That’s so interesting. I think so many parents and adult kids now can relate to that, for sure. Well, let’s get into some of your advice. So a lot of personal finance experts, you recommend really starting with thinking about your money goals, but you do have a unique twist on this tip, and you say that people really need to walk the line between spending everything today and then saving too much. So you really want people to think about finding that balance. Talk to us about that.

Joe Saul-Sehy: Yeah, there is no magic finish line. I always feel bad when I see people sometimes in this movement, the FIRE movement, financial independence, retire early, where all their hopes and dreams are on this unicorn rainbowy moment when they quit their job and all of a sudden, Kim, life is wonderful and all this stuff that they imagined. And yet the sad news is that never happens that way. When you show up, you still show up as you with the same fears, with the same feelings that you had before. So you have to enjoy the journey as much as the outcome. And if you’re not enjoying the journey and you are putting so much money toward the future, that’s super frustrating. So I love doing this goal-setting, but in a way that makes it valuable. It isn’t about the money as much as it is about what do I value in my life and how do I make sure that I’m focusing on those things that I value.

So I feel lucky with my podcast that I get to interview a lot of awesome authors across the financial spectrum. I thought for my book that what Emily, my co-author, and I really needed to do was focus on goals but focus on it in a way that it does work. And so the idea that people have had for a long time around vision boards, I think, is really hitting on something. The fact that I see it that immediately connects with my animal brain and I’m much more likely to get it. So what I like doing, and this is where we start the book, is I like taking just a regular sheet of paper, put it landscape style, put yourself as a stick figure on one end. And then ask yourself, along this line you draw across the bottom, which represents the rest of your life, draw these little bags of money, which are things that you’re going to want for yourself in the future. Maybe I want to work part time, maybe I want to spend more time with friends or family or if I have children. Speaking of children, maybe I need to have a discussion around college. Is that stuff important to me and do I want to pay for part of it? If so, maybe I need a new car every few years or at least a new-to-me car. But whatever those things are, put them out on a timeline. And what that does is some really powerful stuff.

No. 1 is your brain immediately sees all these things on the line and goes, “Well, maybe I can’t get all these, so which one’s most important?” That’s a wonderful discussion to have because too often we’re focused on the things that really aren’t that important, and this really guides us to those things that are the big rocks in our life that we want to get. The second thing it does is we then draw a line from all these bags of money back to today, and we start asking ourself, “OK, how much money do I need to save today for each of these things that I want?” And now my budget, instead of being something I’ve heard that I have to do, which is why a lot of budgets fail. They’re aimless budgets. Now I know the budget is specifically so I can do what I want today and I can get the things that I value tomorrow.

Kim Palmer: I love a good vision board, too. I think it can be such a good craft project. And also I think it helps you see what you’re saying yes to instead of feeling like you’re denying yourself things when you’re making a budget. So it helps you stay positive. So that’s why I’ve always liked them.

Joe Saul-Sehy: Me, too. I’m exactly with you. Because a budget can feel constraining. And if instead of constraining, I know that every dollar I put in this investment, it’s not the investment, it’s about this vacation that I want to take to Africa, or it’s this time that I want to spend away from work with my friends that I wasn’t able to do. Now when that dollar has a name and it has a value, too, it’s so much more positive than, “Oh, crap, I got to go put some money away.”

Kim Palmer: Well, let’s talk about that timeline element because you do get into that as well in the book. So I mean, it is important to have a timeline on your goals, right? Why does that help motivate you?

Joe Saul-Sehy: It motivates me because of the fact that I can then create milestones, and milestones when I was a financial planner were huge to keep my client in that spot, Kim, that you mentioned, which is positive. So let’s take the market right now. The market’s been very shaky. Everything’s been shaky. We’ve got geopolitical risk right now with Ukraine. We’ve got problems in the U.S. where in politics we can’t even agree on what the facts are. We’ve got inflation through the roof. We’ve got all this uncertainty going on. If I know that 10 years from now I want money for whatever the goal might be and I can check in at every six months and know what the milestone is along the way, I’m always going to focus on my zone of control versus all these external factors that I just mentioned. So I love Stephen Covey’s “7 Habits of Highly Effective People.”

And one of those habits is focus on this pot of things that are directly in your control. Then things that you can control or influence. And then third, things that you can only influence. Most of us spend most of our time on things that we really can’t control or influence. What’s the Fed going to do about inflation? What’s the stock market? We can’t do anything about that. But if I get to the six-month mark on my 10-year goal and I’m behind, like a lot of people are right now, I know that I look at my investments first and I say, “Are my investments performing? Am I in the right type of investment for a 10-year time frame?” And if the answer is yes, that I’m in a competitive investment, then it’s not about the investment, then it’s just about what do I need to do? And clearly I can then do a few things.

I can put some more money away toward that goal, which is awesome, Kim, because then I’m buying low, right? To sell high later. Most people buy when things are high, and then they sell in a panic low. But if I know I’m behind at the six-month mark, I can buy low. And then the second thing that I can do is I can decide if my budget is really right for this or is this goal really that important for me? Maybe this thing 10 years out, let’s say it’s I want to buy a cottage or I want to buy a rental property. Maybe I’m OK with 12 years away instead of 10 years. And if that feels OK, I back that goal up and now the amount that I’m saving, I’m not as worried about it. And now I know that I am at a milestone for 12 years, which is great.

So again, I get to focus on what I value instead of on money. Having the value conversation with myself and with the people I plan with is so fun. Having these money conversations is only fun if you’re a money nerd like you and me.

Kim Palmer: Well, I do think you’re right that people do feel out of control in so many ways right now. Like you’re saying, we don’t have control over these external forces. So I think it makes a lot of sense to take control where you can and also gives people, I know for me, too, it just gives me a sense of having some degree of control over where things are going if I just focus on what I do manage, like my own budget. So I think that’s a really great point.

Joe Saul-Sehy: Can I tell you just a little thing to your point, Kim, that could save people — it seems like just a little thing, but it’s something that we can control that might be life changing for people?

Kim Palmer: Yeah.

Joe Saul-Sehy: My cousin does this. I’ve been bragging about this for the last eight months, Kim, and I’ve done nothing with it and I totally should, but I don’t know about you, but I have cut the cable a long time ago, but now I’ve replaced it with, I have Netflix, I have Amazon Prime, I have Apple TV, I have Disney+. I somehow have stayed away from Showtime, HBO Max, the Peacock network and all these other things. But I have four of these, and I only have one set of eyes. I can only watch one thing at a time. So what my cousin does that’s really cool is that he will text me about every three months and go, “Hey, what are you watching on Netflix that’s really good?” And he will then get from me and from all of his friends all the stuff that he wants to binge on Netflix, he cancels everything else and just has Netflix for that period of time.

And he watches those, and then I’ll get a text from him that says, “Hey, what do you like on Disney+?” And then I’ll tell him all those things. So cancel Netflix and just have Disney+. This seems like a really small thing, right? If we’re averaging, let’s say $15 per subscription that we have and we have four and we cut it to one, we now have $45. I’m just going to round it to 50 to make this super easy. That’s $600 a year that we save on this one little mark.

Again, it might be 500, might be 700, $600 a year doesn’t seem like that big a deal, Kim. But if we multiply this one little thing that we can control over a decade and we do it for a decade, that’s $6,000 that we save over a decade. Again, doesn’t seem much until you put it in terms of value. I love to travel, and $3,000 a year is a pretty awesome vacation. If I can take two more vacations every 10 years than I’m already taking now, if I can add two more to that mix every 10 years, now all of a sudden this little tiny thing has become incredible and empowering and so much around what I value when it comes to my life. So focusing on that versus what the Fed’s going to do with monetary policy is so much more fun and so much more positive.

Kim Palmer: Yes, I love that. Those recurring expenses really add up. So one thing you talk about too is just the importance of laughing about your previous money mistakes, not letting them get you down. So please tell us one of your previous money mistakes that you can laugh about now.

Joe Saul-Sehy: Oh, my goodness. So there’s so many. So my very first money mistake that I talk about in the book, I got to college and, as I mentioned earlier, I had no financial experience, and I was at this college, the Military College of South Carolina called The Citadel. And at the Citadel, I marched. I couldn’t really have a job. So those are key points to this story. There was going to be no way for me to pay off anything, and I had to wear a uniform every day. Well, one of the first weeks on campus, I go to Mark Clark Hall, the student union, and there’s this huge line, Kim, out the door, and I don’t remember if they were giving away a stadium blanket or a Frisbee or what it was, but it was for an American Express card. And I thought, “Wow, this is cool. I can use somebody else’s money.

“This is awesome.” So I stand in line to get into debt, like a lot of people do. And it’s always funny to me, if a financial planner’s office had a line coming out the door — they always have kiosks around the world for people just trying to mess up their financial lives — it’d be amazing. But I finally get up to the front; I fill out this card. What’s my income? Zero. I have no money coming in. Second, what are my assets? Zero, right? I have no ability to have a job. You know exactly where this goes. A few weeks later, I get my American Express card. American Express goes, “Hey, you sound like a horrible risk. Let’s give you money.” And so I’m carrying this card around, and the first time we get leave, we go to North Charleston to this mall, me and five friends of mine, and we go to this high-end restaurant, you might have heard of it. It’s called Ruby Tuesday.

Just amazing place. They had a salad bar and the whole deal. So at the end of lunch, and I want to be everybody’s buddy, I want to be people’s friend, and there’s no better way to be somebody’s friend than when the bill comes. I took out that brand new card, flash it to the waiter, and I said, “Guys, I got this, and I’m paying for all of your lunches.” It never once crossed my mind how I was going to pay this bill. Not once. I just knew, “Hey, I can be people’s friends and of course they love me.” Then as soon as lunch was over, we go walking down the mall and like a magnet I go to the most expensive store in this mall, which was Nordstrom. There’s this mannequin. And the year, by the way, is 1987. So it’s like Duran Duran time. And there’s this awesome Duran Duran kind of sweater with this paisley print around the V-neck and this horrible purple color.

And I buy this super expensive sweater. I’m in Charleston, South Carolina. It’s cold two days a year. I can’t wear the sweater anyway, why I’m buying it is beyond me now today. But I get this thing, and then I’m back at school and a few weeks later I open up my mailbox and it says American Express has a letter for me. Well, this is amazing. I’m sure this is a thank you, right? “Hey, thanks so much for taking your friends out to lunch. Thank you for buying the sweater. This is of course American Express, my buddy.” But as you know, it wasn’t that at all. American Express says, “Hey, you owe us.” I don’t even remember what the amount of money was, but “you owe us X amount of funds.” And I’d never thought about it. So I did what any smart person would do. I called my mom and I said, “Mom, we have a problem.”

And Mom said, “No, we don’t have anything. You have a problem, and you need to figure out how to solve it.” And of course, I couldn’t solve it. Within two months, that American Express card was cut up; it was gone. My credit was ruined. It went to a collection agency. I spent the next summer working part-time jobs back home in west Michigan trying to pay off this debt that I had. And it’s funny, though, Kim, so that’s the funny story, but there’s an even bigger thing. I didn’t learn from that like I should have. I still stayed a credit nightmare and a credit disaster. And I’ll tell you, there were two lies that I had that I think a lot of people listening to this still have. No. 1 lie was that I can do the accounting in my head. That I can figure out how much I’m going to owe and I will rationalize.

This stuff can’t be in your head. You have to have some type of budget and some type of tracking system. Once I had those things, I was able to then catch some of these mistakes that I was making. I wouldn’t plan for the muffler dragging behind my car. I wouldn’t plan for these little emergencies. I could calculate out my groceries, my rent, those things, but never these surprises. So I needed to track my money; I needed to have a budget. But the second lie was this: Even though I had bad money habits, I thought that I could earn more money and that would fix my problem. So my first year that I was a financial planner and I was a sham, this is when I really ran out of money, was I’m giving other people financial advice and I’m just a money disaster.

But during that time, I made $85,000 I think my first year as a financial planner, and I spent $100,000 and it didn’t matter. If I would’ve made $100,000, I would’ve spent $120,000. If I would’ve made $120,000, I would’ve made $140,000. You can never ever outearn bad money habits. I had clients that made a quarter-million dollars a year, and still because they had horrible money habits, they were spending more than they made. You have to find a way to at least know the heartbeat. And whether that’s a financial app or a spreadsheet or just looking at it once a week, having this money meeting once a week for just 20 minutes, you have to be able to lock down that budget a little bit.

Kim Palmer: Yeah. Well, one thing that struck me in the book is this idea of a money meeting. And you do say anyone who’s in a relationship where you’re coordinating your money with other people, it is really important to have that regular money check-in. It’s also something I’m a fan of, too, but how do you keep it fun as opposed to stressful?

Joe Saul-Sehy: Well, I like doing this. Even if you’re single, just set the time aside because we’re all busy. So setting 20 minutes aside for yourself and your money is so important. But to your point, it has to stay fun. And I bet a lot of us listening to you and I chat today are money nerds; the non-money nerds in your life are going to go bye-bye to this whole thing if you don’t keep it fun. So the first thing is set a timer for 20 minutes and it can’t go longer. And even if your significant other, your spouse, your planning partner is into it, at the end of 20 minutes, tell them you’re going to stop. And I’ll tell you what happens, by the way, if you keep it fun, and I’ll get into that even more here in a second, and you keep it light, is that then you start having these organic conversations later on.

So Cheryl and I will go on a walk around the block, not our money meeting time, but then we’ll have these deeper conversations that every money nerd knows we have to have. But what we do to keep it fun, besides making it short, is we keep the agenda light. All we do is we look at our expenses from the week before. How did we spend money the week before? And when we first started doing this, we found all kinds of problems. We didn’t realize that our utility bills could be evened out. We didn’t realize some of our subscriptions that were recurring that just went under the radar, stuff we weren’t using. We also didn’t realize that one of our phone packages was just absolutely horrible. And so we ended up with all of these little to-dos, like let’s check in with these things and saved a bunch of money that we wouldn’t have if we didn’t just do this quick scroll.

And then the second thing, have a very open conversation about how we’re going to spend money the next week, what’s coming up the next week. And this avoids money fights. And Cheryl and I, my spouse, we would have money fights all the time because of the fact that we just weren’t on the same page about how we were going to spend money. It was just this little tiny check-in. But last to make it even more fun, what we do is we do it depending on the time of day, we do it over wine or pancakes. I love having it in the morning, which means we’re probably not doing wine, but if for some reason we’re busy in the morning, we’ll pour ourselves a couple glasses of wine, we’ll turn on some light music and we’ll just make it this very relaxed discussion.

I feel like too often money nerds want to kind of pressure someone, but no, we got to talk about our money, and we got to make it like this Camp David Summit. We don’t want that at all. The lighter you make it, the more you’ll get to those big discussions we know that have to happen down the road.

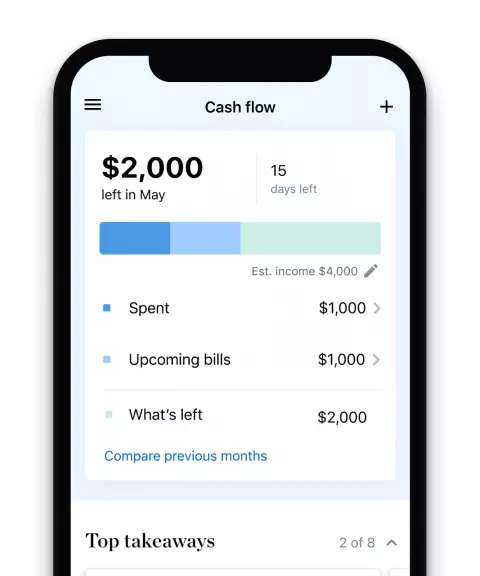

Kim Palmer: Yeah, that makes so much sense. Let’s talk about this money dashboard idea, too, because that’s another strategy that really jumped out at me from your book. So talk to us about this money dashboard. It sounds like it involves tracking your money but also making those hard budgeting choices.

Joe Saul-Sehy: Yeah, I mean, the big thing about a money dashboard is this, is that I like looking at my finances. And when I was a financial planner, I would look at my client’s finances this way as if we’re the CFO of a company. We’re not a family; we are a company. And then I think, would my board of directors really like the way that I’m managing this company? And usually the answer is no. We all make these phenomenal decisions at work, and then we go get all emotional at home and make these horrible decisions. So when we work for somebody else, why do we keep it logical and we don’t do that for us? So the very first thing is setting up this money dashboard, which means we can have our money in a lot of different places and most of us do, but that creates a bunch of complexity in our head.

So we need to have some place where we’re tracking everything and we can see it in one place. And so if in the last week I got into trouble, I can look back and I go, “Yeah, well, I went out to dinner almost every night at a restaurant.” Of course I’m going to pay a bunch more, but then second, and this is the look ahead the next week, I need to set up a budget based on that. So if I went out to dinner five times last week, maybe I’ll go out to dinner three times this week. And now I’m budgeting much clearer how I’m going to spend my money in the future.

And this is the lockdown I talked about earlier, but it’s impossible to do if you don’t take all these different places where you have money and give yourself a dashboard where you can very quickly see where things are going off the rails and where you’re really doing a great job.

Kim Palmer: Yes. So important. Well, let’s also talk about increasing your income. I know that right now, of course, so many people are stressed out financially. And so increasing your income sounds like a pretty appealing concept. You talk in the book about launching a side hustle on top of your main job. Is it as hard as that sounds? Or do you think it can be realistic for a lot of people?

Joe Saul-Sehy: I think it can be realistic, but you have to have very realistic expectations. Let’s talk about your main job first, though, because studies show that your boss in most cases does want to give you a raise, your boss wants to give you one. But studies show that you have not asked. And I’ve seen so many statistics that show that women are very much guilty of this not advocating for themselves. They don’t want to rock the boat; they’re worried about job security. And so because of that, they don’t ask for raises. But that’s not just women. Women [are] more susceptible to that. Men, too, don’t advocate for themself enough. So you need to figure out, “How do I get more money?” And we walk through this, not just in the book, but what’s cool that I like is that at the end of every chapter, I talk to people that are experts in the area of that chapter.

And a woman, Mori Taheripour, who does negotiating on behalf of the NFL Players Association and other groups, she teaches negotiating at Wharton, gave me a lot of great advice on how to do this. The first thing is, you don’t go in there saying, “Joe needs new shoes,” right? Saying, “Hey, hey, I need a raise because inflation is really high.” And by the way, this is a great year to get a raise because if you don’t get a 10 to 12% raise, you’re falling behind. So you need to make more money just to keep up with inflation. But boss doesn’t want to hear that. Boss wants to hear how you are making an impact and how you’re going to help the company. And Mori told me something that’s really interesting that I hadn’t considered, Kim. And it’s this: Your boss often is not the decision-maker. You might think they’re the decision-maker, but at the very least, they might have to bounce it off some other people.

So think of your boss as your advocate and you’re trying to arm them with as much great stuff as possible. But if you really, really want to side hustle, it’s building this outside business like an Etsy store or selling something online, doing maybe it’s a podcast. A podcast I can tell you is a horrible way to try to make money. But building something for yourself is interesting because studies also show you become a better employee when you own your own business.

You understand better what the business is trying to do. And when you’re operating your own side hustle business, it really helps you with that main business. And it also feeds you. I mean, these two businesses can really work well together. You have to watch out because you don’t want to be doing your side hustle job on company time. But certainly if you can juggle the two things, building this empire yourself might also be a way to one day not have to ask for a raise because you’re making enough money doing that that you can say, “You know what? I’m going to quit my job and just do the side hustle.” And that can be pretty rewarding.

Kim Palmer: Yes, I totally agree. I’m such a fan of Etsy, too. So amid all of this strain and serious discussions and the stress people are feeling, why do you find it important or valuable to bring a sense of humor into all of these discussions?

Joe Saul-Sehy: I love this question because I know from “The Stacking Benjamin Show,” which we call the greatest money show on Earth, because it truly is a circus. And on purpose, people think that we’re not serious. And what’s funny, Kim, is that I think that keeping it light is the best way to learn. If we lower the temperature, if we make it fun, if I tell you how I have screwed up everything and I still did OK, that we can all come out of this much, much better, we’ll relax and do a better job with our money.

Kim Palmer: Well, thank you so much, Joe. Thank you for being on our podcast. Do you have any final thoughts to share with our audience?

Joe Saul-Sehy: Oh, the biggest one of all, guys, if I can leave you with one nugget, think about this. You want to think about whatever your unique talent is; you don’t want to think about your money. So think about your money in these terms. Automate all the little stuff because the more that you can keep your investments automated, the more you can set up yourself systems, the less your brain is going to spend spinning on these little things, the more you’ll be able to do things like ask your boss for a raise, make more money. Do these things that you love, these things that you value. Automation systems, Kim, I think is the heartbeat of a good financial plan.

Kim Palmer: That is great advice. Thank you. And that is all we have time for this episode. To share your thoughts on how to budget, pay off debt or manage finances, shoot us an email at [email protected] Also, visit nerdwallet.com/podcast for more info on this episode. And remember to subscribe, rate and review us wherever you’re getting this podcast. And here’s our brief disclaimer. We are not financial or investment advisors. This Nerdy info is provided for general educational and entertainment purposes and may not apply to your specific circumstances. And with that said, until next time, turn to the Nerds.