The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Player embed

Welcome to NerdWallet’s Smart Money podcast, where we answer your real-world money questions.

This week’s episode starts with a conversation about how to know if you can file your taxes for free.

Then we pivot to this week’s money question segment, where we answer a number of questions about filing taxes in 2023.

Check out this episode on any of these platforms:

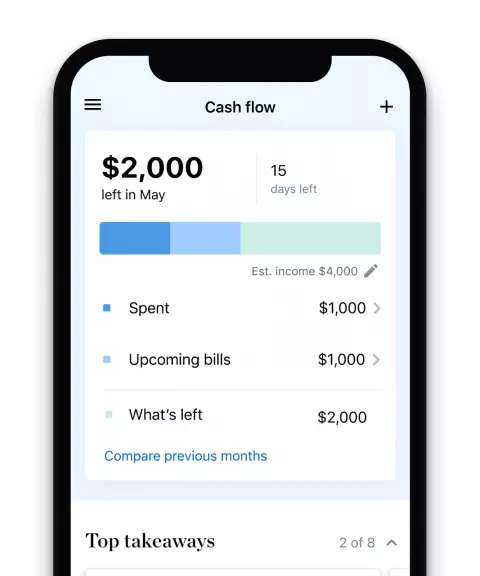

Before you build a budget

Track all your spending at a glance to understand your trends and spot opportunities to save money.

Our take on filing taxes in 2023

One of the most important things to know about filing taxes in 2023 is the deadline: This year, your tax return is due to the IRS by April 18. If you can’t meet that, you’ll want to file for an extension to avoid penalties. Also, a number of pandemic-era tax benefits have expired, which means that people may see smaller tax refunds than in recent years. On the bright side, the standard deduction is higher this year due to the standard inflation adjustment.

If you are new to filing taxes, realize that it might be easier than you think. This is especially true if your tax situation is fairly simple — meaning you have a single source of income and didn’t have any major life changes, like getting married or buying a house, in the past year. And if your adjusted gross income was $73,000 or less, you can file for free.

But if your tax situation is fairly complex — such as if you are married and filing separately, have multiple sources of income or received dividends from investments — hiring the help of a qualified tax professional can save you a lot of angst. Regardless of whether you hire help or go the DIY route, have some understanding of the “why” behind your tax situation to optimize your taxes in future years.

Our tips

-

Just file your taxes. Even though it’s stressful, the penalties of procrastinating are not worth it.

-

Make sure you understand your taxes. Whether you’re filing jointly for the first time, dealing with freelance income or have an unexpected tax bill, dig into the “why” behind your situation for a smoother tax season next year.

-

Get help. There are lots of great ways to get help with your taxes. Many of the online tax preparation services offer live help from a CPA. And you can also hire someone locally.

More about taxes on NerdWallet:

Episode transcript

Sara Rathner: All right Sean, be real with me, are you done with your taxes yet?

Sean Pyles: No, I’m not right now. Are you, Sara?

Sara Rathner: No.

Sean Pyles: Well, hopefully we have great company in our many listeners who are also somewhat procrastinating right now.

Sara Rathner: Hey, cats and kittens, tax season is in full swing. Are you as excited as I am? Which is to say not at all. Great. If you’re in the midst of filing or you haven’t even started yet, we’ve got you covered, don’t worry.

Sean Pyles: Welcome to the NerdWallet Smart Money podcast, where you send us your money questions and we answer them with the help of our genius Nerds. I’m Sean Pyles.

Sara Rathner: And I’m Sarah Rathner. Send us your money questions by calling or texting us on the Nerd hotline at 901-730-6373. That’s 901-730-NERD. Or you can email us at [email protected] This episode, Sean and I take on a number of your tax questions. We’ll cover how to know if you can DIY your taxes, when married couples might not want to file jointly, and what’s new for this tax year.

Sean Pyles: But first, we’re talking about how many Americans are getting ripped off when they file their taxes by paying for expensive glossy looking software. Joining us in this conversation is NerdWallet data writer Liz Renter, whose recent column dives into this topic. Liz, welcome back to Smart Money.

Liz Renter: Thanks so much, Sean. I feel like it’s been a long time, but I’m happy to be back with you.

Sean Pyles: We’re happy to talk with you.

Sara Rathner: All right, Liz, you found that Americans are wasting billions of dollars paying to file their taxes. What the heck?

Liz Renter: Well, the deal is that 70% of federal taxpayers qualified to file their taxes for free through the IRS, and only about 3% actually use it. And so what that means is in the last year for which data is available, 2021, 101 million people probably paid to file their taxes when they didn’t need to. And we’re talking about billions of dollars in overspending here.

Sean Pyles: And there’s a program that people can use to get connected with free filing software, right? What is that?

Liz Renter: Yeah, the whole program is known as the Free File program. It’s basically a partnership between certain software providers known as the Free File Alliance and the IRS, and the goal is to provide online software access to the lowest earning 70% of taxpayers. Which is a lot of folks, when we talk about the lowest earning 70%, that’s not like only low income people. That’s median income people, that’s people over the median. A good chunk of taxpayers should qualify for this.

Sara Rathner: So what does income need to be to qualify?

Liz Renter: So every year they reset an income cap if needed, so that 70% always qualify. And so for this year, if you’re filing in 2023, your 2022 taxes, your adjusted gross income needs to be $73,000 or less in order to qualify for the Free File Program.

Sean Pyles: OK. It’s worth noting that folks can also use any of these free file services if they make more than that, but they’ll have to pay.

Liz Renter: Right. Exactly. And to that point, a lot of people don’t know what their adjusted gross income is, and especially if you’re close to that 73, you might be like, well, I don’t know yet if it’s going to be over or under this year. So you can start the process through the free file page at irs.gov and work your way through it knowing that if you do come in over that, you will have to pay.

Sean Pyles: Yeah, you’ll have to pay. But chances are that using one of these platforms will still be cheaper than paying for any of the really more popular, more expensive tax filing softwares that folks might be familiar with.

Liz Renter: That’s true. And I think part of the reason for that is these websites and tax providers are really stripped down. They work very well. They help you through the process, but you’re not being bombarded with opportunities to upgrade or things to add on like you do at some of the other providers. So they do remain pretty reasonable.

Sean Pyles: OK well, if so many folks are eligible, why aren’t they using it?

Liz Renter: That’s the like 101 million-dollar question. I think two reasons: a lack of information and a lack of clarity. And so what I mean by a lack of information is not enough people know about it. They don’t know the program exists, they don’t know where to find it. And it’s kind of funny, the IRS for their part is like, well we put it in press releases every year and we put it on social media. But I’m a Nerd. I don’t follow the IRS on social media. I don’t know anybody who does.

Sara Rathner: I can’t say the IRS and I are like Instagram buddies.

Liz Renter: Right, exactly. Clearly that campaign isn’t reaching who it needs to. So that’s the lack of information part. And then the lack of clarity part is when you’re looking for something online, whether it’s tax software or boots, you go to Google or Bing or whatever your search engine that you like to use is, and what the problem is when you go to the search engines and you type in free file, or file my taxes for free, or even IRS free file, the first results are sponsored ads and they’re coming from providers that aren’t part of the Free File Alliance.

And so it can be really confusing if you don’t necessarily know what to look for. It’s going to be really easy to click on those ads and be upsold on these software products that you may not need.

Sara Rathner: So how can people bypass these search results and go directly to a place where they can file for free?

Liz Renter: So best place to go is straight to the IRS, said no one ever, but really IRS.gov/freefile is where you should start. I think it says, help me file for free or help me prepare my taxes for free, and it’ll ask you a couple questions to get you a provider that’s part of the Free File Alliance.

Sean Pyles: The IRS is also working on a direct file path where you can file your taxes with them directly, right? What’s happening with that?

Liz Renter: Yeah, so they actually announced really recently that they’ll be coming out with a report in May that talks about the next steps or the path forward for this direct file program. But we’re talking about the federal government here, so if they’re going to give us a report in May, I imagine the actual direct file platform won’t be around for a couple years. And it depends on what the report says, how much it’s going to cost, do they have to go to Congress to pay for it, there’s a lot that goes into that. But I think the fact that they’re actually looking really closely at this is a good sign because the tax filing process in this country is extremely complex.

We’re not all tax accountants, but we’re expected to know a whole lot when it comes time to file our taxes. So I’m excited to see what the report says and to see where it goes from there.

Sara Rathner: Yes, I definitely think that for a process that most people have to go through by law, I mean maybe we shouldn’t have to spend a ton of money to do something that’s required.

Liz Renter: Yeah.

Sara Rathner: Just a thought.

Just me putting that out there into the universe for whoever might be listening who maybe works for the IRS or the government.

Sean Pyles: Yeah. I’ll also speak to my personal experience using one of these free file platforms in the past. I’ve had to pay for it, but I found it to be pretty straightforward to navigate. And I’ll admit I was a little skeptical the first time I used one, so I actually cross-referenced my taxes with one of the big name platforms that I’ve used in the past, and I got virtually the same results each time. I had to put in a little more work in terms of entering my information, but I’m happy to do that if it means not having to pay 40, 50 bucks to file my taxes each year.

Sara Rathner: Yeah. I mean, I would say that when I did my own taxes when I was younger and I paid for software to do that and I wish that at the time that I knew that this was an option and would’ve saved me a lot of money because yeah, it wasn’t well communicated. I had no idea until literally today when we sat down to record this episode that this was the thing.

Liz Renter: So we are all learning here.

Sara Rathner: Yeah.

Sean Pyles: Yes.

Liz Renter: Well, one thing that people should know before they begin this process is that the Free File Program itself is a federal program, so this applies to your federal tax return. Now, you may also have a state tax return — at least one — to file depending on your circumstances, and you may have to pay for that even if you qualify for free file.

Now, 20 states have programs that are similar to the federal program, and so you wouldn’t have to pay in that case. Bottom line, these tax software providers are going to walk you through that and they will let you know what the charge is for your state. But it’s just important to know that some states will charge you and some will not. It just depends on where you’re at and what they’ve passed there.

Sean Pyles: Liz, do you have anything else folks should keep in mind when it comes to filing their taxes hopefully for free this year?

Liz Renter: Yeah. Well, this is actually for folks that have to pay. If you don’t qualify for free file or if for whatever reason, maybe it’s brand loyalty, you want to go with a big tax platform, I would just say watch out for those upgrades. Know what you’re paying for, know how much you’re paying for it, and really think hard about whether you need it. These companies are out to make a profit; that doesn’t necessarily make them big and evil, but it does mean that you need to be conscientious of that and know what you might be signing up for.

For example, do you really need to pay extra for audit protection? Do you need to pay extra to have someone on call for the next three months with questions? So just think really hard about these options. In the past, we’ve asked people in a survey that we do every year, what are you scared about when you file your tax returns? And a good chunk of people are really scared of being audited, but when you sign up or you pay $50 for audit protection, do you even know what the risks are of being audited? What are the chances that you would be audited? And if so, what would the outcome be?

Sean Pyles: And how comprehensive would that coverage be? That’s what I’m wondering about too.

Liz Renter: Yeah, exactly. So before you just click the box “just in case,” make sure you know what you’re signing up for and whether or not you actually need it.

Sara Rathner: Yeah, good rule of thumb is whatever you ended up using last year, if you signed up for three months of extra help last year, did your taxes close the book on them and then never thought about it for the rest of the year, maybe you don’t necessarily need to pay for that additional assistance.

Liz Renter: Right.

Sara Rathner: Because you can also call the IRS and ask questions.

Liz Renter: Yes. And they’re actually answering the phone this year, I’ve heard.

Sara Rathner: Oh, good. That’s a nice change.

Liz Renter: Yeah, I think it was last year they reported answering 10% of calls that came in during filing season. So I don’t know what it is this year, but apparently they’re improving.

Sara Rathner: Great. I’ll take it.

Sean Pyles: Well, Liz, have you filed your taxes yet?

Liz Renter: Oh my gosh, you’re putting me on the spot. So actually my goal for this weekend is to put together all the paperwork to get it done so you know, baby steps here.

Sean Pyles: OK. One step at a time for sure. Great. Well, thank you so much for joining us.

Liz Renter: Yeah, absolutely. It was fun to talk with you guys.

Sean Pyles: Before we move on, a reminder for our listeners, we are working on an episode about how the pandemic changed people’s finances, and we want to include as many of your voices as we can. We’ve heard from folks who were able to save a lot of money and who completely retooled their spending habits, but we are greedy podcast hosts and want to hear from more of our beloved listeners. So how has your financial life changed since March 2020?

Sara Rathner: Maybe you decided to start a new business, or you ended up moving back in with your parents after a job loss. Maybe you just stayed home a lot and saved a bunch of money. However the pandemic changed your finances, we want to hear about it.

Sean Pyles: Leave us a voicemail or text us on the Nerd hotline at 901-730-6373, that’s 901-730-NERD. You can also email us at [email protected]

Sara Rathner: Now let’s get onto this episode’s money question segment.

Sean Pyles: We’re about to dive into a number of our listeners’ questions about taxes in 2023, and to help us answer these questions on this episode of the podcast, we are joined by investing Nerd and regular Smart Money guest, Alana Benson. Welcome back to Smart Money, Alana.

Alana Benson: Hi guys, thanks for having me.

Sean Pyles: Sure. Before we get into these questions, a quick disclaimer. We are not tax advisors, we are not investment advisors. We are providing this information for general educational and entertainment purposes. So just remember that as we discuss all of these complicated things in this episode. OK, so Alana, to start, can you give us a quick rundown of a few things that are new with the 2023 tax season?

Alana Benson: So there are several things that are new this year, but probably the most important one is that the tax filing deadline for your 2022 taxes is April 18th, 2023. Over the last few years, this has fluctuated due to COVID-19, but it’s April 18th. As usual, some tax provisions were adjusted for inflation. So for example, the standard deduction for all filing statuses, it’ll be slightly higher for tax year 2022 than they were in tax year 2021.

And something else that’s really important is that people may be seeing smaller refunds when they file their taxes this year due to the expiration of a couple of different pandemic benefits. So you may not see massive tax refunds this year like you did last year.

Sean Pyles: OK, so maybe a bit of a bummer year for tax refunds for a lot of filers.

Alana Benson: Yeah, unfortunately last year maybe inflated our expectations a little.

Sean Pyles: Yeah, a lot of things were inflated last year.

Alana Benson: Yeah. I mean.

Sara Rathner: Speaking of things that were not inflated last year, Alana, last year the stock market was a little bit rocky, which is putting it mildly I guess, and a number of folks might want to write off some investment losses. Can you explain what that is and how people can take advantage of it?

Alana Benson: So tax-loss harvesting is a technique to cut your tax bill by selling your investments at a loss in order to deduct those losses on your taxes. And this can be a little complicated, so stick with me. But basically taking those losses and applying them to your taxes that you owe can kind of help you offset some or all of your capital gains tax that you might owe on other investments that actually performed really well and you sold for a profit. But the problem is that if you didn’t do it before December 31st, 2022, you won’t be able to utilize it on this year’s taxes. But maybe if you’re listening to this, this can help you on next year’s taxes.

Sean Pyles: OK. Can you give us an example to see how that might pan out for folks?

Alana Benson: Yeah, so let’s say you are a single income tax filer, just a single person, and you have some stock in a company called The Cool Company, because we’re all dorks. Let’s say you originally purchased the stock that you have for $10,000, but the market has gone down, and now it’s only worth $7,000. If you sold that stock, you take a $3,000 loss on your investment, but with tax loss harvesting, you could use that $3,000 capital loss to reduce your taxable income for the current year. So you basically subtract that off of your taxable income.

Sean Pyles: All right, and there are a number of caveats to this, right?

Alana Benson: Oh, so many, there’s always asterisks with all of these things, and this is a good rule of thumb for taxes in general. So be sure to just ask, say, what are the things that I’m not thinking of or I’m missing?

Sean Pyles: Yeah.

Alana Benson: Because there will certainly be something. So with tax-loss harvesting a couple of things, it applies only to investments that you hold in taxable accounts. So you can’t really do this on IRAs or 401(k)s, things like that. So you can’t really try to minimize your gains in those accounts. So you can only do tax-loss harvesting in taxable accounts.

The next thing, it’s not really financially fruitful if you’re in a low tax bracket since the idea behind tax-loss harvesting is to lower your tax bill today, it really most benefits the people who are in higher tax brackets. Then the upside of losing, so the gain of this is limited to $1,500 to $3,000 a year. So investors are only allowed to claim a limited amount of losses on their taxes in a given year.

Sean Pyles: Yeah, and if you are considering doing this, this would probably be a good time to hire a tax pro because it can get quite complicated.

Alana Benson: Definitely. Yeah. Unless you are feeling extremely savvy and confident, it may be a great idea to talk to a tax professional.

Sara Rathner: And don’t wait until the last minute to talk to a tax professional because they have other clients, their schedules are full or filling up. You don’t want to wait until late March to find somebody to talk to because they’re not going to have the availability. So ASAP everyone. You might even have to make a few calls.

Alana Benson: You can wait if you are waiting to talk to them next year. Because like I said, you can only take advantage of tax loss harvesting in the same tax year, so you could really be getting a jump on next year’s taxes.

Sara Rathner: That’s true. If you waited until after the new year to do this, then we’re talking next April. But if you did this before the end of 2022, then you’re going to want to talk to somebody for this tax year. So yes, absolutely depends on your situation.

Sean Pyles: OK, well now let’s get to a listener question that’s somewhat related to this topic. Here it is. They wrote, “Good morning. I invest through Vanguard. I automatically reinvest any dividends I receive in my brokerage account. Is this money taxed annually as ordinary income on my 1040? Thank you, Travis.”

Sara Rathner: Ooh, that’s a lot of jargon.

Sean Pyles: Yes. And quick note here, Vanguard is a NerdWallet partner, but that does not affect how we talk about them. So Alana, what say you on Travis’ question?

Alana Benson: The biggest thing that people seem to forget is that dividends aren’t free money. And let’s just remind people, some stocks or ETFs or other investments pay out dividends. So basically you’ll get paid by this investment essentially, and you’ll get some money maybe once every quarter. But they’re usually taxable income, so when you get this money from your stock, you have to pay taxes on it. But how much you’ll owe is determined by whether your dividends are qualified or non-qualified investments.

Sean Pyles: OK.

Alana Benson: This is one of those asterisk things, they get very complicated. So as always, if you’re looking at dividends, you may want to speak with a tax professional.

Sean Pyles: So qualified or nonqualified, what does that mean?

Alana Benson: So to be determined as a qualified dividend, there’s three things that usually come into play. So the first is that it’s paid by a U.S. corporation or certain foreign entities, and basically it’s a U.S. company, which usually if you are purchasing stock, it’s a safe bet that it might be. So that’s usually pretty easy to satisfy. The second is that it is actually a dividend in the eyes of the IRS. There’s a couple of things like insurance premiums that companies kick back that don’t count. So again, fairly easy to fall into the qualified category. And then the third thing is that you held the underlying stock for long enough.

Sean Pyles: This again might be another place to call in the tax pro, you can just throw some money at and say, please sort this out for me, please do a good job.

Sara Rathner: This is absolutely a moment where I would throw money at this problem.

Alana Benson: Yeah.

Sean Pyles: Yeah.

Alana Benson: So if you satisfied those three things, it’s a U.S. corporation, it’s actually a dividend, and you held it for long enough, the tax rate is going to be either zero, 15% or 20%, depending on a lot of different factors. That being said, the tax rate on nonqualified dividends is usually the same as your regular income tax bracket. So typically nonqualified dividends are taxed at a higher rate than qualified is a general rule of thumb. There’s obviously exceptions, but so typically you’d want to have qualified dividends instead of nonqualified because you’re going to be taxed more favorably because of that.

Sean Pyles: Gotcha.

Alana Benson: So now that we kind of have all of that out of the way, there’s all of these caveats, but basically to your listener’s question, reinvested dividends are treated the same way as cash dividends. So the way that they’re going to be taxed, even if you’re reinvesting them, is going to depend on whether they’re qualified or nonqualified, and you will likely be taxed on this.

The exception to this rule, and I am curious how your listener falls into this category, the exception is if you’re earning dividends on your investments through a Roth IRA. And if that’s the case, your reinvested dividends will grow tax free. And that’s why Roth IRAs are such a great retirement vehicle because you get to sidestep a lot of these rules like that would apply if you were investing in a standard brokerage account.

Sean Pyles: Interesting. OK.

Sara Rathner: That’s a lot.

Sean Pyles: So again, calling up pro, having them sort through what kind of account you’re investing in, and that may determine whether or not you’re going to be taxed on this as ordinary income or not.

Sara Rathner: All right, next question. This one feels a little bit less complicated but no less important. So let’s help this listener out. “Hi NerdWallet, my name is Kayla and I have a question regarding the tax season. I’ll be filing my taxes for the first time this year.” Mazel tov, Kayla. “I’m 23 and my parents have been filing for me as they’re dependent. Any suggestions for first timers on how to go about the tax season and common mistakes to avoid? Am I even qualified to get a tax return this season? Do I need to get a tax advisor? Please help. Thank you so much, I really enjoy your podcast as a first generation future millionaire, Kayla.” I love that. Good luck to you.

Sean Pyles: Yes.

Sara Rathner: I wish you the best in all of your endeavors. I love this.

Alana Benson: I love that aspiration. We should all be thinking of ourselves as a future millionaire.

Sean Pyles: Well, if we are saving for retirement as ambitiously as we maybe should, then that could be in all of our futures. Well, to Kayla’s question, Alana, what do you think folks should know when they are going to be filing their taxes for their first time? And what are some common mistakes to avoid?

Alana Benson: The biggest mistake probably is just thinking that you don’t need to file a tax return. So pretty much everyone is going to have to file, and filing is different than owing tax or paying tax. Filing basically just means getting your paperwork in order.

So for instance, if you are under 65, you’re single and your gross income is at least $12,950 a year, you have to file. Most people are going to fall into that category. The financial limit for people who don’t even have to file is very, very low. So the next thing to look out for is filing itself. A lot of people don’t file their tax returns and that can cause huge, huge problems. So no matter what you owe, even if you can’t pay what you owe yet, you should still try to file on time or file an extension if you can’t make the deadline. But filing an extension will give you more time to file your taxes, but not more time to pay your bill. But skipping the extension can lead to harsher penalties. At the bare minimum, just file your taxes and do it by the deadline. That’s the biggest thing that we can say.

Sean Pyles: Right, because if you don’t pay your taxes, the IRS will charge interest on what you owe and they will come for you. They can garnish your wages. It can get messy very quickly.

Alana Benson: Exactly. And it tends to get worse over time. So as that interest compounds, it’s just getting worse and worse and worse. So the sooner you get on it, the better.

Sean Pyles: OK. Let’s talk about filing on your own versus hiring someone. It seems like our listener isn’t sure what to do. How do you think folks can determine whether or not they should hire someone to file their taxes or if they can DIY it?

Alana Benson: So, normally I do not recommend using your own confidence as a gauge for things in life. Those who are overconfident are typically less well-suited to whatever the task is, and those who are less confident may be more prepared than they think. But you kind of have to use your confidence gauge here. So have you filed your taxes before? Is your tax situation fairly simple? This all depends on the person, but if you’ve got a pretty simple situation and you feel comfortable maybe using an online tax preparer, you feel OK using a computer and just answering the questions yourself, then you may be able to do it by yourself, and that’s fine.

But if not, then you may want to hire someone. So a couple of questions to ask yourself to gauge your confidence is did your life situation change this year? Did you start a new job? Did you buy a house? Did you start a business? All of those things can impact your tax situation. Some other things to think about, did you have multiple streams of income or investment income? So I know a lot of freelancers who frequently don’t realize that maybe they should be filing their taxes quarterly, and then the end of the year comes and they have a huge tax bill. And so a tax professional could really kind of help you with that planning so that you don’t end up in that situation.

Sean Pyles: Right. This is a question that I find so interesting because I’ve grappled with it for many years on my own. I would love to hear how each of you handles this situation. Do you guys hire someone or do you go it alone?

Alana Benson: So historically, I have always handled my taxes by myself. I like to file my taxes the second I get all of my forms. In the past I was a freelancer, so I did kind of have, I think the first year that I was a freelancer, I had that shock of realizing that I hadn’t actually paid taxes on my income that I had received and so I ended up owing. But I’ve always done it by myself and I like to do it as soon as possible because we should mention, the sooner you file, the sooner you get your refund and you may actually get it faster if you file earlier just because there’s fewer refunds getting dealt with by the IRS earlier in the season so they can turn them around a little more quickly.

But that being said, I did, I got married this year, and my husband and I will be filing our taxes together for the first time, and I’m very curious to see how that goes for us because we tend to have a different take on how we should handle our taxes.

Sean Pyles: OK.

Alana Benson: So we might be hiring someone this year.

Sara Rathner: Yeah, actually for me it was getting married that changed me from a DIYer to somebody that hired help. And what complicated that was the second year we filed jointly, we both had contract and freelance income. In my case, it was in addition to a W2 job as well. And so it just went from my taxes taking maybe 20 minutes to all of these questions that I didn’t have the answers for. And in our house, I am the money person because of what I do for a living. I didn’t want to be the money person for this. It felt like too tall of an order for my knowledge base. And you talk about using your confidence as a gauge. I would honestly say the people that I know that know what they don’t know are usually end up better off because they recognize when they’re in over their head and they give up and they’re just like, “I’m going to call in a professional to help me out with this ’cause I just don’t know what I’m doing.” And when you’re overwhelmed, you’re just less likely to do things on time.

Alana Benson: I think that’s such a great point, Sara, because if you are sitting there and stressing about this and saying, man I really don’t know how to answer these questions or I don’t know what to do. That may be a very clear sign that you need some help. And I might be in that same situation this year. My husband has a rental property, and so they have rental income and I realize that I have no idea how to handle that, and so that’s the reason why we’re likely going to work with someone this year.

Sara Rathner: And I will say working with somebody, it’s still a lot of homework. It’s still a lot of work on your part. They do a lot of the heavy lifting for you, but it’s still your responsibility to assemble all of the documents that you receive for all of your different accounts and for your work and your income and send them to that person in a timely fashion. If you are working with a professional, you have to hold up your end of the bargain here.

Sean Pyles: Right? I’m still on the DIY path when it comes to my taxes. I thought this was going to be the year where I have to hire someone to file my taxes for me. And I talked it over with my financial advisor and I said, “Hey I’m filing individually. I’m not married. I didn’t buy a house in the past year. I’m just going to be taking the standard deduction so my taxes aren’t really that complicated.” And she said, “Hey, you’re probably still fine just doing it on your own.” I’ve been doing it on my own for a number of years now and until I get married, I’ll probably keep doing that because at that time I’m also going to have a complicated situation where I have my house, my partner has his house, and sorting out how that’s going to work with taxes is something that I’m happy I’m not dealing with this year, but eventually I’ll have to bring someone in to work this all out for me.

Well, we’ve been talking a lot about filing jointly and filing separately as a married couple, and we received a number of questions about this. So Alana, for those who are filing jointly for the first time, yourself included, what tax benefits are there for married couples and what should they keep in mind?

Alana Benson: The most important thing to keep in mind as is the role with literally everything with relationships is, communication. So ideally you’re aware of any big financial issues before you go to file your taxes together for the first time, but if you’re not, now is the time to sit down and have that conversation. Does anyone owe any money to the IRS? What is your filing style? Do you want to wait until the last minute? Do you want to get it done as soon as possible? Those are kind of the things that outside of the specific rulings or benefits for being married. It’s just really important to know about each of your financial picture and how you want to go about handling those things together for the first time.

But some of the benefits, typically your tax rate is lower, which is great. That’s something that I will hopefully be enjoying this year. I’m excited about that. You can claim a higher standard deduction, and there’s lots of much more specific things that is exciting if you are filing for the first time. But that’s something that you definitely want to speak to a tax preparer about because a lot of these things are determined by your income limits. And if you add both of your incomes together, do you fall into the category where you would qualify for certain things?

Sara Rathner: Our next listener question asks about the opposite — a married couple filing their taxes separately. So here we go, “Hey Nerds, my husband and I usually file our taxes jointly. However, this year we’re wondering if it makes more sense for us to file separately given the differences in our salaries. For context, my husband runs his own wedding photography business and makes about $120,000 annually. I work in health care for a large hospital network and make about $40,000 annually. We don’t have any children or dependents. Every year we owe a large sum of money when we file our taxes since my husband doesn’t have any taxes withheld from his income during the year. Any refund I may see if I filed independently goes toward the taxes owed. I’ve always assumed filing jointly would benefit us both, but wanted to know if there would be more benefit to filing separately. Thanks, Diana.”

So what are the benefits to filing separately when couples have different incomes?

Alana Benson: Diana, I feel your pain. I think I will be in a very similar situation this year. Like I said, my husband has that rental property and so he gets income from that, but he does not pay quarterly taxes or isn’t really planning on that until now. And then I was expecting a big refund, so I think my refund might get eaten up by what he owes. And this kind of gets into whether you keep your money in one big pot or if you separate it or how you kind of organize your money. My husband and I have no joint finances, so you feel that a little bit more when it’s not all going to the same place. So I understand your frustration, Diana.

That being said, because of the tax break you get, typically most couples will really benefit more from filing jointly, but if one spouse owes child support or back taxes, that might be a reason to reconsider. In this instance, it could potentially be beneficial to file separately since Diana’s tax bracket is much lower because of her income than his, and he’s not filing quarterly taxes. But that’s something that you’d really need to speak with a tax advisor about. And realistically, this is going to be a personal decision. If you keep all your money separate and you want your tax refund, that’s one thing. If all your money’s together and you’ll benefit from lowering your husband’s tax bracket, that’s kind of another. But in this case, you should probably speak with a tax professional.

Sean Pyles: Right. It seems like the husband in the situation is a contract employee, and we should probably talk about things that he can do to avoid a large tax bill next year. I’m thinking about making sure he’s paying enough in quarterly filings.

Alana Benson: Definitely. So contractors have to make quarterly estimated tax payments, which can break up their tax obligation into payments throughout the year. So if the husband isn’t making these payments or is not making large enough payments, that could lead to a huge unexpected bill. So planning ahead of time and figuring out those quarterly taxes might be really beneficial.

Sara Rathner: And I’ll also say it sounds as if this husband is a business owner, not just a contractor. So that’s another thing to keep in mind if you have a small business. Even if you’re a sole proprietor who walks dogs for extra income or you actually run your own business, this is the same situation. Just you really want to talk to somebody and get some guidance about these quarterly filings before you end up with a giant tax bill.

Sean Pyles: OK, well, that is all we have for our listener questions for the tax episode 2023. Alana, do you have any parting thoughts for those who are in the midst of filing their taxes right now?

Alana Benson: Start as soon as you can, and if you have any doubts at all, talk to a tax professional.

Sean Pyles: All right. Thank you so much for talking with us.

Alana Benson: Thanks for having me.

Sean Pyles: And with that, let’s get on to our takeaway tips. Sara, will you please start us off?

Sara Rathner: Sure. Number one, just file your taxes. Seriously, even though it’s stressful, the penalties of procrastinating are not worth it.

Sean Pyles: Next up, make sure you understand your taxes. Whether you’re filing jointly for the first time or dealing with freelance income or have an unexpected tax bill, dig into the why’s behind your situation for a smoother tax season next year.

Sara Rathner: And finally, get help. There are lots of great ways to get help with your taxes. Many of the online tax preparation services offer live help from a tax professional, and you can also hire someone locally.

Sean Pyles: And that is all we have for this episode. If you have a money question of your own, turn to the Nerds and call or text us your questions at 901-730-6373. That’s 901-730-NERD. You can also email us at [email protected] Visit nerdwallet.com/podcast for more info on this episode. And be sure to follow, rate and review us wherever you’re getting this podcast.

Sara Rathner: And here’s our brief disclaimer. We are not financial or investment advisors. This Nerdy info is provided for general educational and entertainment purposes and may not apply to your specific circumstances. This episode was produced by Sean Pyles with help from me, Sarah Rathner, and Tess Vigeland. Kaely Monahan mixed our audio. We had editing help from Hal Bundrick. And a big thank you to the folks on the NerdWallet copy desk for all their help.

Sean Pyles: And with that said, until next time, turn to the Nerds.