We are NerdWallet’s Smart Money Podcast, where we answer real-world money questions.

This week’s episode focuses on the latest jobs report. We discuss what it means and how you can get involved.

Watch this episode on one of these platforms:

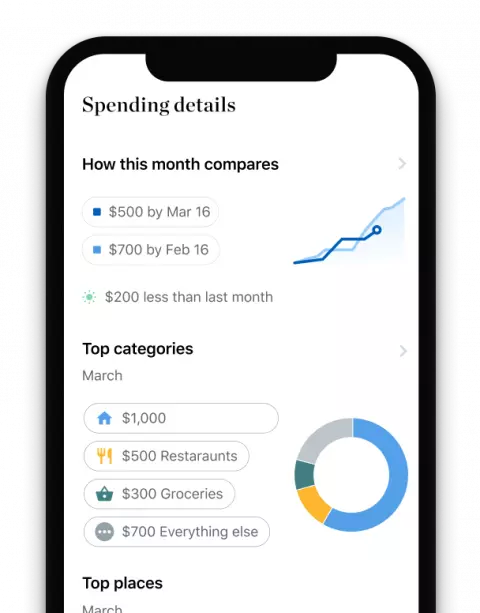

Keep track of all the money that you make

Get a quick overview of your bank, card and cash accounts.

Our take-on the jobs report

Despite rising interest rates and inflation, the labor market held firm this year. According to the U.S. Bureau of Labor Statistics, December 2nd data, wages are rising, there are many opportunities, and overall employment is strong.

The unemployment rate in 2022, which moved between 3.5% to 3.7% from March, is an example of the labor market’s stability. However, wages have risen for some workers, particularly those working in transportation and warehouses (+8.81%) as well as leisure and hospitality (+6.38%). While this may not be enough to keep pace with inflation, wage increases can mitigate some of the pain of rising prices.

However, signs are beginning to emerge that the labor market is changing as we move into 2023. There have been a lot of layoffs in media and tech since 2022’s end. According to layoffs.fyi which monitors tech-related layoffs, more than 140,000 tech workers were laid off in 2018. Many expect layoffs to continue as the Fed raises interest rates. It’s a good idea to brush up on your federal and state legal protections.

Learn more about inflation and the job market on NerdWallet:

Episode transcript

Sean Pyles: This is the NerdWallet Smart Money Podcast. We welcome you to send us your money questions and we will answer them with the help our brilliant Nerds. Sean Pyles is my name.

Anna Helhoski: And I’m Anna Helhoski. For more information, please call or text the Nerd Hotline at 901-730-6370. That’s 901-730-NERD. You can email us at [email protected] if you like what we hear. Follow us wherever you get your podcasts. Please leave us a recommendation and share it with your friends.

Sean Pyles Anna and I discuss the new jobs report and its implications for the job market in 2023. We also discuss whether or not we should be concerned about layoffs in the New Year.

Anna Helhoski Liz Renter, NerdWallet data editor, is joining us in this conversation.

Sean Pyles Liz.

Liz Renter: Hey, Sean. Hey, Anna. How is it going? It’s great to be back.

Sean Pyles It is always a pleasure to speak with you.

Liz Renter: Great.

Sean Pyles: Liz, telling stories from data is a major part of your job. What story do you see in the numbers?

Liz Renter: I believe there are mixed signals. I think it’s true that any data released by government agencies is going to show some things in one direction and others in the other. The overarching story I get from it is that the labor markets are cooling, with no significant negative effects yet. But, I will tell you this: Your perspective is a big factor in what story or version you see when you look at data like this. As a consumer and worker, I don’t want unemployment to be high. However, as someone who watches the Fed, it might be higher.

Sean Pyles Could this slow down the rate of increases?

Liz Renter: Yes. Although the unemployment rate will be a sign that the Fed rate increases are working, I believe there are other indicators in the jobs report that indicate it. There were 260,000 new jobs in the past month. This is the same as last month. Some people see that and think, “Wow, it should cool faster.” It was expected to add 200,000 jobs last month. However, it’s still a plateau and significantly lower than it was one year ago. It was about twice as high as a year ago. Things are moving in the right direction, though they may be a bit slower than others would like.

Sean Pyles (Liz): We’ve also noticed wages rise according to government data. Could you please talk about this?

Liz Renter: In general, wages and inflation move in the same way. The wage-price spiral is a term you’ve likely heard. We want to slow down that spiral or stop it. However, wages rise and firms must increase their prices. Inflation is a result of rising prices. Employees demand higher wages. Yes, wages have increased, but not as much as we expected. This is one number we’d like to see drop.

Sean Pyles Could you talk about the typical response of the labor market to rate increases, which we have seen throughout the year?

Liz Renter: As interest rates rise, the labor market tends to soften and labor demand falls. This means that employers are hiring less. They are looking for fewer workers. As things become more difficult, layoffs can occur, which could lead to a downward trend. That’s the trend. So, where are we in this cycle? Labor demand is declining and the jobs report does show that labor demand has fallen. A report earlier in the week, the JOLTS report had similar indicators that indicated that demand is declining.

However, we don’t expect layoffs to rise. This is a great thing because, if you recall, when the Fed raised rates last spring there was much talk about a “soft landing”. They were trying to balance this trajectory. We would like to see the market relax a bit. We want the labor market to slow down, but not to see large layoffs or a recession. The slow pace at which things are moving right now is dependent on how you view it. Some people might think that the Fed’s actions aren’t making enough of an impact. It could appear that it is making an impact. It is slow, and could lead to a situation in which a recession or massive layoffs do not occur.

Anna Helhoski – It seems like the Fed is annoyed at the slow rise in unemployment. But, we are not in a nightmare scenario Liz where high unemployment would lead to persistently high inflation. Despite the fact that unemployment is still low, people still get paid and continue to spend at higher rates than what the Fed would prefer.

Liz Renter: Yeah. It’s a delicate balance between all these factors. I see these numbers every day. It’s difficult to understand the numbers, as I know you both look at them daily. It’s hard for me to imagine myself in the Fed’s position and trying to make policy calls. There are so many moving parts.

Sean Pyles: Yes. They keep happening.

Liz Renter: Right. This particular set of circumstances has never happened in such a way before, so it’s hard to balance.

Sean Pyles: Yes. The job market is so weird right now. Talks about resignation turned to concerns that the recession might lead to mass layoffs. Could you talk a bit more about what is happening and what people might expect?

Liz Renter: One interesting thing is to consider how the early days and current situation of the pandemic impacted the labor market. For example, you may recall a year ago or perhaps not even a year ago when there were help needed signs everywhere. People were closing down their businesses because they couldn’t find workers and there was a labor shortage.

This is still true to some extent today. But what we are seeing is that there is a decrease in labor demand. What I wonder if is that employers are recalling situations where they couldn’t get staff on duty. They will reduce the number of job listings, but they will not let go of the staff members they do have. They won’t let that happen.

Sean Pyles However, it is a great way to retain employees. This could cause them to raise their prices, and then the cycle begins.

Liz Renter: I believe it is important to remember that as inflation falls, which we will be able to see in the coming month, and as we see the effect of the Fed rates that were started back in March, dollars are going further. Wages will continue to rise even though the gross will slow down, and prices will continue to rise even though inflation or rate of rise will slow. We’ll eventually reach a more favorable equilibrium where our dollars are moving further and we don’t feel as overextended when going to the grocery store. But it will take time.

Anna Helhoski : Liz, you brought up something very important. It is that there are simply not enough workers. I was looking at the labor force participation rates. The rate is fairly steady at the moment, but when you compare it to pre-pandemic, it’s definitely lower. Workers are also able to job hop and continue doing that, as you can see in the quit rates. They aren’t really going down. This seems to be a pretty solid foundation.

Liz Renter They can always find a job if they don’t get the wages they desire. Your point is well taken. I believe some of this will continue in the long-term. Along with the many economic shifts we’re experiencing right now due to the pandemic and the war overseas, we are also seeing longer-term demographic shifts which will continue beyond 2023.

We now have an aging population made up of baby boomers who had planned to retire from the workforce. Some of them left early due to the pandemic, and younger people are not replacing them as quickly. It will be interesting to see how this plays out. Immigration will be a key factor in this. We will see that if we can bring workers from other countries to the United States, it will help offset some of the shortage. However, this is something we’ll continue to see for many years.

Anna Helhoski : Liz, layoffs are the most popular question. Are you optimistic that there will be more layoffs in 2023? These seem to be a mixed bag.

Liz Renter: Oh. Predictions.

Anna Helhoski: Everyone’s favorite.

Liz Renter: Yeah. Predictions, economic forecasting, all that. It’s hard no matter what time we’re speaking, but right now it’s very difficult. We’re seeing, as we mentioned earlier, many moving parts, and we don’t know what the Fed will do or how the economy will respond. So whether we see more layoffs or not is very similar to the million-dollar question: Are we going to experience a recession? Both are closely linked. You’ll get a different answer depending upon who you ask. That doesn’t mean that certain people are better than others. These facts are being disputed by some very intelligent economists. My guess or educated opinion is that layoffs will continue to be industry-specific and relatively isolated. This is similar to what’s happening in the tech sector right now. Broad-based layoffs that signal a deep, significant recession are less likely.

Sean Pyles These layoffs are happening at companies that aren’t necessarily profitable or at divisions that aren’t making money. Companies are now more focused on turning a profit than the big, dreamy tech goals that have fueled much of these companies’ growth over the past decade.

Anna Helhoski, Well, e-commerce grew so much in the early days of this pandemic. A lot of these companies were trying to expand quickly and had a lot of employees. Now some of that demand is starting to decrease, and we are now seeing layoffs in tech. The latest figures show that 150,000 tech workers have been laid off by 900 companies this year. Now we are starting to see the news in media. CNN, Gannett and Washington Post all have started laying off people. When I speak to labor economists, I hear that there is good news. It’s the small companies that can compete with the big guys and might be able attract talent from this new pool. Even if you are laid off, it might not be for very long. It would be very concerning if people were to remain unemployed for prolonged periods.

Sean Pyles: One thing to mention is the importance knowing your rights as a federal, state, or city employee. Employers may attempt to terminate you without regard to labor laws and ethics. It’s only when employees speak up that companies can try to honor the legal requirements.

Anna Helhoski It’s important to note that the number of workers organizing themselves and unionizing has increased substantially in the past fiscal year. While it’s not possible to reach mid-century union levels, it is a sign that workers are starting to organize and receive more pay, better hours, and greater protections.

Sean Pyles: Yes. Also, you should check out the websites of the federal and state Department of Labor to make sure that your legal protections are up-to-date before anything bad happens. In our show notes, we will include a link to this federal website. You can find that at nerdwallet.com/podcast. Liz, what are your final thoughts on all of this?

Liz Renter: I think that I would just echo what i’ve said in couple interviews, which is that there are still a lot scary things on the news. We’ve also changed some scary topics. The economy, layoffs, and a recession are the real scary things. Let’s just say “Relax.” It doesn’t make sense to lose sleep over something that even the most educated economists can’t agree upon. Sean, you are right that a plan is essential. We recommend having an emergency fund in case of an emergency. This should also apply to layoffs. You should know your first steps and what your plan is if you find yourself in financial trouble.

Sean Pyles: Excellent advice. It’s all right. Thank you Liz for taking the time to talk with us.

Liz Renter: Yeah. Absolutely. It was as much fun as ever.

Anna Helhoski : That’s it for this episode. You can reach the Nerds with any questions regarding the job market, or money in general, by leaving a voicemail or texting us at 901-730-6375. That’s 901-730-NERD. Email us at [email protected] Sean Pyles and I produced this episode. Our audio was edited by Kaely Monahan.

Sean Pyles: Here’s a brief disclaimer. We are not investment or financial advisors. This Nerdy information is intended for entertainment and general education purposes. This information may not be applicable to your particular circumstances. With that being said, you can always turn to the Nerds until next time.