A Uniform Commercial Code (also known as a UCC) filing is a document used by lenders to establish legal rights to assets used by borrowers to secure loans. In the event of default, the lender can seize collateral.

UCC filings may only cover one piece of collateral. However, lenders can file a blanket lien that covers all assets of the borrower. Lenders who issue small-business loans often file a UCC lien.

Did You Know…

The Uniform Commercial Code (UCC) is a set law that governs commercial transactions in the United States. These laws are uniformly adopted by states and help to promote interstate commerce. Article 9 of Uniform Commercial Code provides guidelines regarding transactions that are secured by property or assets. This is known as UCC filing.

What is a UCC filing?

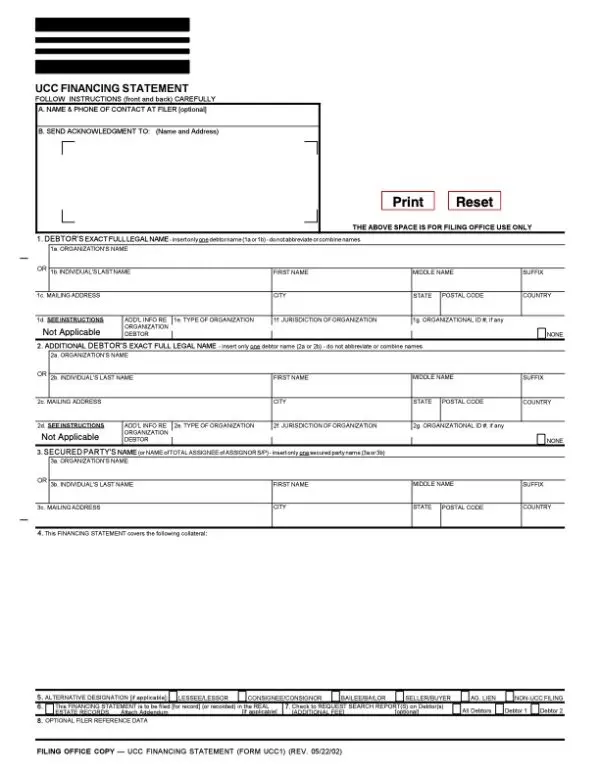

Lenders have the right to first claim collateral from borrowers if they file a UCC. UCC liens are usually filed with a UCC financing form, also known as the UCC-1 financing document.

This document must be submitted to the secretary office of the state in which the business (or the borrower) is situated. The UCC-1 financing document identifies the assets and properties that the lender claims to, as well as letting other creditors know about its security interest in those collateral.

UCC-1 financing statement to New York state.

UCC Liens can be filed on a variety of personal and/or commercial assets including real estate, inventory and receivables as well as vehicles, machinery, and equipment.

A UCC lien filed with the secretary-of-state’s office becomes public record. Anyone can search online for active filings .

UCC filings are usually valid for five years, although the details can vary from one state to another. Your lender may apply for a continuation if your loan remains active after the five-year period. If necessary, the lender may also file amendments and addendums.

Types UCC filings

Two types of UCC filings can be used to obtain a loan for a business.

-

UCC lien can be filed on certain collateral. The lender can take these assets if you default on a business loan. It cannot claim any other assets of the company.

-

Blanket lien. This type covers all assets of a company, not just collateral. Lenders can sell or claim any assets that are needed to cover losses if you default on your loan.

The UCC filing that a lender uses to file a UCC can vary depending on many factors including the type and amount of the business loan , your company’s qualifications, and the individual lender.

Special-purpose loans that require collateral liens are more likely to be approved for specific purposes, such as inventory financing or equipment financing. Blanket liens are used more often for online loans, SBA loans, and standard bank loans.

What a UCC filing can do for your business

A UCC filing is generally not harmful to your business. It serves only as an official notice for other creditors that your lender holds a security interest in some or all of your assets. UCC filings can affect your credit score, put your company at risk, and/or make it difficult to obtain future financing.

-

Impact on business credit Your credit score can be affected if you default or make late payments.

-

Your company’s assets are at risk. If you default on your loan repayments, a lender will file a UCC lien. Your assets will be safe as long as your lender is repaid. The lender may seize your assets if you fail to repay the loan.

-

This could hinder your ability to obtain future financing. Your new lender will search your business to determine if there are any liens. Lenders are often reluctant to take second place on an assets company and could deny your application for business financing or offer limited funding if there is an active UCC filing.

How do I remove an UCC filing

Even if you pay off a business loan the UCC filed on that financing will still be active until it expires, usually after five year. You can remove a UCC lien from a loan you have repaid to help you get other funding options.

Your lender can request that you submit a UCC-3 form in order to remove a UCC file.

You can file a dispute with the credit bureau to remove a UCC lien from your credit report.