Travel insurance promises to protect you in the event of unforeseen circumstances during your trip. It may seem obvious to travel overseas but it can also happen domestically.

Learn about travel insurance and the credit cards you can use to cover your domestic trip.

Travel Insurance Types

Travel insurance comes in many forms, such as health insurance, rental car coverage and trip interruption insurance. You may not need all types of travel insurance depending on your itinerary. However, here is a list you should expect:

How can you purchase domestic travel insurance?

Is it possible to purchase travel insurance when traveling within the United States? You can. You can, however, not all coverage types may be offered to you and there may also be certain qualifications to qualify.

Chase Sapphire Reserve (r) travel insurance, for example, requires you to be 100 miles from your home before the emergency evacuation and transport benefit is activated. The trip should last at least 5 days, but not more than 60.

Some travel insurance providers indicate their plans do not work in the U.S. Your plan won’t work unless you travel internationally. GeoBlue’s health insurance plans only cover countries that are not the U.S. They can be purchased by people with a valid plan.

Travel health insurance for domestic travel

You can get travel insurance in the U.S., whether you want comprehensive coverage or just a medical plan. SquareMouth, for example, allows you to compare quotes from different insurance companies.

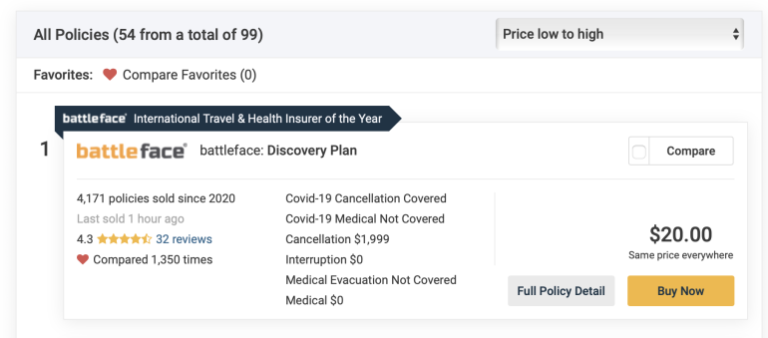

We searched for an American 32 year old traveling in the U.S. This trip was a total of $1,999 over two weeks in the summer.

SquareMouth provided results for 54 service providers. The lowest charge was $20.

This plan does not include health insurance. Use the search filters to find insurance policies with this type of coverage.

Filtering out domestic travel insurance results limits total results but does not affect pricing.

All policies will include coverage for primary care, pre-existing condition coverage, emergency medical and medical evacuation. The cheapest option is still only $34.47, even with those additional options.

If you are unfamiliar with this term, the primary policy is the one that pays first for your claims. If you go to the doctor on your vacation, then your primary insurance will pay for it first. In the event that your primary insurance plan has been exhausted, and you have secondary coverage as well, secondary insurance will cover the remaining costs.

You should know what the differences are so that you can be covered completely during your trip. If you do not have primary coverage, your secondary policy will become primary.

Travel Cards with Domestic Travel Insurance

Are you looking for cheap insurance to cover domestic trips? There is no cheaper travel insurance than that offered as a complimentary benefit by most travel cards. Many other credit cards offer travel insurance, too. We have already discussed the benefits of Chase Sapphire Reserve (r).

In general, these cards offer travel insurance without requiring you to pay any money. You will only need to charge your trip cost to the card, and then the insurance is automatically activated. It doesn’t matter if you are traveling within the country or abroad.

These cards offer free travel insurance.

Conditions apply.

Recap of Domestic travel insurance

We hope we have answered your question, “Do I require travel insurance when traveling within the United States?”

It is up to you whether you decide to purchase travel insurance. Travelers with a high tolerance of risk are more willing to go without insurance and hope that everything goes as planned.

Some people may prefer to be covered in the event of a trip cancellation, medical emergency or rental vehicle insurance.

Compare quotes from different insurance companies to ensure you get a policy which suits your requirements. Check out complimentary travel insurance provided by different credit cards and see if their limits are within your budget.

To maximize rewards, you can use

It’s essential to choose a credit card for travel that puts your priorities first. Our picks of the top travel credit cards for 2023 include those that are best for: